|

Money Matters 7 MAJOR FINANCIAL MISTAKES TO AVOIDBy MARY LYNNE DAHL, CFP®

July 06, 2018

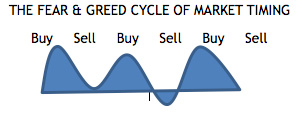

Mistake #1. Overspending. Make no mistake about it; this is the engine that drives the train. Everything else depends on this one issue. If you don’t get this one right, you will not do well with all of the other potential ways to succeed and you will fail financially. Let’s agree at the start to avoid overspending. So, how then, do you know if you overspend or not? If you cannot pay off your credit cards in full every month, you are overspending. If you cannot pay the department store revolving charge account in full every month, you are overspending. If you have to borrow money in order to invest, you are overspending. If you cannot save money and leave it to accumulate in a savings account, you are overspending. Does this sound pretty hard core? Maybe it is, but this mistake is easy to get roped into. Excuses like “I know it is expensive but…” or “I deserve this” and “I don’t have a choice” are lies we say to ourselves when we overspend. Overspending is a habit that is as hard to quit as other addictive behaviors. It enslaves us to our debt burden and is one of the most powerful roadblocks to financial security and financial success. If you are an overspender, be prepared to be poor/or and stressed all of your life. If you don’t like the sound of that, resolve to become disciplined and break this nasty habit. Mistake #2. Failing to Participate in the Company Retirement Plan: If you are lucky enough to have a retirement plan at your job, contribute the maximum to it that it allows. If you are also lucky enough to have an employer who offers a match, you will automatically get the additional contribution the match provides if you fund your plan to the max. Many people incorrectly believe that they cannot afford to contribute much, if any, to their company retirement plan, but this is a serious error in logic on their part. Since their own contributions are pre-tax, a large portion of whatever they contribute is money that would otherwise be sent to the IRS, so making the maximum contribution is using tax dollars to fund your future retirement income. The employer match is a gift that avoids tax also. Some people will say that it is not important, or not that much money, or won’t make much difference, but they are dead wrong. It is critical to accumulate for retirement, and doing it pre-tax, with employer matches if available, is a huge advantage for any worker. Even without the match, it is a powerful method to getting where you need to go in your travels towards financial security. Saving and investing for your retirement should be your #1 goal, once you get your spending in order. It should be more important than saving in a college fund or a fund to buy a house. Don’t let anyone tell you that you can start putting money aside for retirement later. Make it your top priority and go the max allowed. That includes ROTH accounts outside of the company plan as well. Do all that you are eligible to do and do the maximum allowed by the IRS. Mistake #3. Buying too much house. As much as owning a home is the quintessential American dream, lots of people spend too much on a home and get trapped in a cycle of putting too high a percentage of their take-home pay into the house of their dreams. It starts with wanting something a little more than you can comfortably afford, then furnishing it, landscaping it and doing some upgrades to it. Then there is maintenance and the unplanned repairs that inevitably happen and bingo! Your home is consuming all of your excess income and more. You are trapped with a great house that sucks up too much of your money. Get used to vacations at home, doing yard work and indoor projects. Be prepared for increases in property taxes, too, because upscale homes, even if they start off modest, are valued at higher property taxes than lesser value homes. You insurance will be more also, so get used to that as well. But why put yourself in this position in the first place? Warren Buffet, one of the wealthiest people in the US, could live in a fabulous estate if he chose to but he still lives in the home he bought decades ago in Omaha, Nebraska. He chose to live in a modest house and have a modest lifestyle in spite of becoming one of the most respected investment experts and a multi-billionaire many years before doing any upgrades to his modest home. The best advice you can take when home buying is to buy less than you can afford. You can upgrade and add on later, without borrowing money, and avoid becoming a slave to a home that owns you instead of the other way around. Mistake #4. Failure to have a household or personal budget. Even if it is not written down, you should know how much you spend monthly and annually, on routine living expenses like groceries, gas, utilities, taxes, recreation etc. You should be clear on how much you pay in federal income taxes, insurance for car, home, rentals and medical plans. You cannot control your finances if you are in the dark about what comes in and what goes out. Part of your budget, or spending plan (a more realistic term) should be an emergency fund that you contribute to regularly and is cash in the bank, for unexpected expenses that crop up from time to time, like a new refrigerator, a car repair, getting laid off of work etc. Your spending plan should include all categories of spending, monthly, quarterly and annually, in order not to leave out something that you do not pay for monthly. Without a spending plan, you will find it hard to control your finances and they will end up in control of you, which is a miserable way to live. Most people who say that they cannot save money do not have a budget, a spending plan or any idea of what comes in and goes out of their bank accounts monthly. Mistake #5. Getting the wrong mortgage. For many people, a 30 year mortgage is a no-brainer, but you should not agree to one. Instead, opt for a 15 year mortgage. Yes, your payments will be slightly more, but in a low-interest-rate economy, not by much. The additional interest you would pay on a 30 year mortgage can be shocking. Just ask for an amortization print out on both a 30 and a 15 year mortgage to see proof of this. Another mortgage to avoid is an ARM (adjustable rate mortgage), especially when interest rates are on the rise. You can end up with a very high interest rate and a very high interest payment in just a few years, and you will be stuck. Opt for a fixed rate in all cases. Mistake #6. Lack of adequate medical insurance. This is difficult a problem, considering that medical insurance is pretty expensive, particularly in some states (like Alaska). The only other option,, however is the potentially overwhelming costs of medical treatment that can run into hundreds of thousands of dollars quickly. One accident, one major surgery, one chronic illness…..any of these can bankrupt the average family or individual. Having at least minimal coverage, such as catastrophic medical insurance, is far better than nothing and less expensive than more comprehensive policies. There are also several cooperative groups that offer a type of coverage that is not exactly insurance but does pay for medical treatment if needed; these are often available through churchs or faith-based organizations designed for this purpose. Mistake #7. Poor Investment Decisions. The 2 most common are based on fear and greed, as follows: FEAR; Keeping too much cash in the bank. Cash in a bank account, whether a checking or savings account (including a CD) should be limited to money you are keeping liquid for emergencies and short term, planned purchases. Keeping ALL of your savings in cash instead of investing some of it, is unwise. Cash in a bank account, no matter what the interest rate is, will always go down in real value over time, because it subjects dollars to inflation, which reduces their value over time. Bread that cost $2.00 per loaf 10 years ago now costs $5.00 or even $6.00 (2018 prices) in many stores across the country. Your invested dollars should keep up with inflation, at a minimum. Better yet, they should exceed inflation in value. Bank interest never pays more than inflation rates. Only keep enough cash in the bank to protect you in a real emergency or in order to save up for a major purchase and avoid taking on too much debt. Keeping all of your investment money in cash is a sign that you are making financial decisions based on fear and emotion, not rational thinking. GREED: Trying to Time the Market. Fear and greed fuel the theory that you can “time the market”, which refers to getting in and out of the stock market at certain times in order to avoid being in the market if/when it crashes. No one can know ahead of time the day on which the market will move up or down. Even if you get lucky and do get out right before the market drops, you will miss getting back in when it suddenly goes back up again. For proof of that, take a look at market returns from 1996 – 2016. The most widely followed market benchmark is the S&P500. If you were invested in it for that period of time, your annual return would have averaged 7.7%. Remember, this period of time includes the market bubble and crash of 2008-2009 that did so much damage in the short term. Using the S&P500 annual average return, an investment of $100,000 would have grown to a value of $440,874 over those 20 years. However, if you tried to time the market during this period and were out of it entirely and missed the 10 best days of those years, your annual average return would be only 4%, which would have resulted in being worth $219,112 for the same 20 years. Still worse, if you were out of the market and missed the 30 best days of those years, your annual average return would be -2.4% and the value of your $100,000 would be $61,517 after the same 20 years. Missing just a few of the best days in the market can and does cost a lot, and market timing is the reason this happens. Market timing is based on greed and fear. People jump in because they hear that people are making a lot of money in a good market. They want a piece of the action. They want to get rich as fast as possible, but they fail to understand the rules and the risks. They wait and watch the media reports, they hear people talking and then they go for it. Usually, they wait too long and get in at or near the top, then the market drops and they panic and get out because now the greed has evaporated and is replaced by fear. It is like a two-sided coin with fear on one side and greed on the other. No matter how you flip it, you usually lose.

Mistake #7: Retiring Too Early. If you want a comfortable and secure retirement, you will need a sum of money accumulated or a retirement resource that is about 20 times your annual income in the year that you retire. So, if you want annual income of $50,000 per year, you will need $1 million in a retirement plan or personal investments. If you have Social Security of $25,000 and it is available when you retire, you will need half that amount, or $500,000. If you retire before Social Security is available, you will need enough to get to the age when you can take Social Security. The younger you are at retirement, the more you will need because it has to last longer. Most Americans do have Social Security benefits but many do not have pensions or company retirement plans. If that is you, you will need to accumulate enough on your own, without the help of an employer. If you do have a company retirement plan, your plan will need to grow enough, for as long as you are a participant in the plan, to reach the goal of replacing your wages. This means that you must choose investments that grow in value and/or produce income, preferably both. Too many people, when their finances are analyzed, lack enough for a comfortable retirement at 65, but various studies report that over 60% of Americans opt to retire early, at 62 or earlier, and when asked, a majority of people say that they would retire at 55 if they could. After more than 34 years of giving financial planning and investment advice, I have to say that this is almost always a mistake. It takes a lot more money to retire than most people realize, and those early retirees who do not know this, or make guesses on how much income they will have in retirement are generally in for a real shock when they retire early and find out a few years later that they need more income. Many just go back to work, if they can. Others cut their expenses, if they can. Some take in renters, if they can. Many sell their home and scale down to a smaller place, if they can. Some adopt a simpler lifestyle, if they can. Those that cannot do any of these things end up in debt. I have seen it happen many times. As medical science becomes able to keep us alive longer, we face more years as “retired” than in the past. Many of us are fairly healthy even into our late 80’s, so working to age 65 or 70, at least part time, is a better plan than early retirement. It allows the worker to contribute more to a retirement plan at work or in a ROTH, it increases our Social Security benefits so that when we do begin to take them they are higher amounts and it decreases the number of years that we have to fund after we do quit working. It also appears to improve our mental and physical health in most cases. Studies on this subject indicate greater personal satisfaction among older people who work after normal retirement age. The same studies also report better physical health among retirees who do not retire early. If you are not yet retired, think about this and consider the advantages of working to age 70. Don’t overestimate the amounts of income that you think you will have and don’t underestimate how much you will actually need. Factor inflation into your retirement income estimates. Remember; the cost of everything doubles in only 10 years if inflation is 7%. At 3.5%, which is the historical average annual rate of inflation for the last 70 years, the cost of everything doubles in just 20 years. So if you start out with just enough, you will have less than half of what you need in 10 or 20 years of retirement, thanks to inflation. Be realistic, be willing to work long enough to accumulate enough income and assets to assure a secure retirement that will keep pace with inflation at whatever rate it ends up being. Don’t guess at this and don’t put off crunching the numbers. If you get it wrong, it is too late, so make plans to get it right.

On the Web:

Representations of fact and opinions in comments posted are solely those of the individual posters and do not represent the opinions of Sitnews.

E-mail your news, photos

& letters to editor@sitnews.us

|

|||||