|

Money Matters AFTER THE DIVORCE – SO, NOW WHATBy Mary Lynne Dahl, CFP®

February 24, 2013

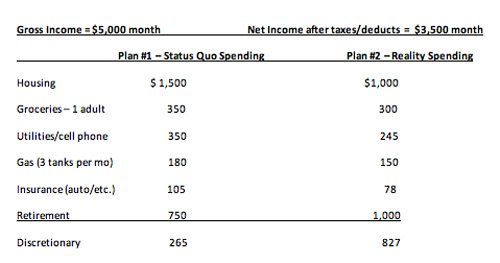

So, what happens after the dust settles, the house is sold, the proceeds split, the retirement dollars divided and the debts allocated to the divorced individuals? Keep in mind that each person is now going to have to support a household on 1 income, where before he or she had 2 incomes to support the household. This will necessitate a lot of adjustment, in high income brackets as well as in medium or low income brackets. No matter how much income and money the couple had jointly, each one now has much less to live on in almost all cases, so adjustments are inevitable. The goal in every divorce settlement should be that both parties can start over with some money for retirement, little or no debts and enough income for each person to support a modest standard of living (except for the very rich and Hollywood celebrities). If that can be achieved, then the couple can get on with their lives, separately, and recover gradually from the financial wreckage that divorce creates. The place to start is by taking a realistic look at spending habits. This means to build a spending “plan”. This is a list of all sources of income, on the left side of the paper, compared to how that income will be spent (expenses), on the right side, itemized and totaled. Monthly works best, but it is important to remember that some expenses occur quarterly or annually; those amounts should be calculated as monthly (1/12th of the total) for good control of cash in/cash out. Without a specific plan, spending easily reverts to the habits that were developed during the marriage, based on 2 incomes. Those old habits may have been part of the reason for the failure of the marriage, so they are important. Now, with only 1 income, spending as if you had 2 incomes will not work anymore. This is an opportunity, therefore, for starting fresh, with different priorities, different values, different goals. It is not punishment; on the contrary, it is a reward for that person who views his or her glass as half full rather than half empty. In other words, it is a matte of attitude. Make a pact with yourself to do this for yourself, for your future, for your pleasure, for your well being. Do it for you. Call your spending plan whatever it means to you, but don’t call it a budget. That is a negative term. I like “spending plan” because although I am extremely disciplined with money, I do like to spend it. Some people call it a “financial security plan” or “my cash flow plan” or “my goals and dreams plan”. Call it whatever rings your bell, but get started on it and rejoice that you are doing this very smart thing, for yourself, finally. Here is an example of a very simple spending plan, after some tinkering with it and straightforward “talking with self”. The categories are simplified in order to save space, but the idea is easy to understand as shown. See how easy it is to trim and create the comfort of having enough. Notice I said “enough”, not more. Remember, this is all about attitude. The happiest people are not the richest people. They are the people with “enough”.

Plan #2, however, leaves this person with $827 of discretionary money to spend any way he or she likes. Maybe a little reward for being good (but just a little one, please), or maybe this person will be driven to save it as cash and accumulate it for a major purchase down the road, like a house, condo or replacement car. A really smart person will use credit cards lightly, paying the bill in full every month. He or she might plan to split the discretionary spending into 3 categories, one for savings, one for fun (credit cards) and one for investment, in growth and income mutual funds, for the long distant future (which will arrive sooner than expected). Whatever….it is a better plan than Plan #1 and it isn’t that hard to achieve. It is reasonable to resist doing this, for lots of reasons. Mostly, it is not fun in the usual meaning of the word, and after a divorce, sometimes it is hard to do things that are not much fun. However, it is really fun to succeed at something, especially with money involved, and it is also time to face the facts, so sit down and do the spending plan. No one ever arrives at a goal by winging it. It requires planning. Your goal now is to recover financially, rebuild your life and retire comfortably some day. When the spending plan is in place, work on a second plan, to get back in shape and become healthy, because divorce can take a few years off of your life in the stress department. Do both of these things for yourself, not for anyone else. Take control of your money, which means spending, and take control of your health, which means good nutrition and exercise. If the debts remaining after the divorce are split fairly, so that each party can reasonably pay them off with the income he or she earns, the first priority is to pay them off and never let them accumulate again. Never, never, never. Getting totally out of debt, especially after a divorce, is a grand and glorious feeling. It is one of the best ways to feel better and it is absolutely magic when it comes to rebuilding self-esteem. I recommend it highly! It is the main highway to financial freedom. Very often I find that the person struggling financially does not need more money; they need less debt. Debt results from overspending. When the debt is paid off totally, you now have excess money to save and invest for your own future, however you want to live in the future. A little sacrifice now is the best medicine, believe me. Having a secure and comfortable future and a nice retirement is worth much more than living beyond your means now. Living beyond your means, keeping up with the neighbors and co-workers or friends is a dreadful and meaningless trap. It is debilitating and hurtful. It never results in anything worthwhile. Resist that temptation to buy stuff just to make yourself feel better; it won’t last and it won’t help you 10 years down the road. Make a new rule: before spending any money over a set amount ($100 is a good rule of thumb), think on it for 5 whole days. If you still really, really-want and absolutely cannot-live-without and must-have that item on day 6, buy it. You will be surprised, however, that you often will no longer want or “need” that item, if you can make yourself follow the 5-day rule. Developing the habit of saying no to yourself, instead of yes, is great discipline and will be the engine that drives your future financial success. Once you have paid off your debts, have saved up enough for 3-6 months of expenses, have a little emergency fund in place and are feeling pretty good about your finances, begin an investment plan. The place to start is a careful examination of your own ideas about risk and reward. Investing does involve risk, and there are no investments that do not carry some type or degree of risk. Often, beginner investors make the mistake of being too extreme. They either are too conservative or they take too much risk. The reality is that risk is everywhere, in our jobs, our relationships, our personal choices, our values and how we handle our money. Have that self-talk about risk and be realistic about it, but do start an investment plan as soon as possible after a divorce. You may be the only person to look out for your welfare for the rest of your life, so get started now. You can do it, and you definitely do deserve it.

Related Column:

On the Web:

©2013 Mary Lynne Dahl, CFP® is a Certified Financial Planner ™ and partner in Otter Creek Partners, a fee-only registered investment advisor firm in Ketchikan, Alaska. These articles are generic in nature, are accepted general guidelines for investment or financial planning and are for educational purposes only. Mary Lynne Dahl©2013

|

|||