Ketchikan General Election is Tuesday, October 3, 2017SPECIAL BOROUGH TAX & ALLOWING TRANSPORTATION NETWORKS IN CITY ON BALLOTSBy MARY KAUFFMAN

October 01, 2017

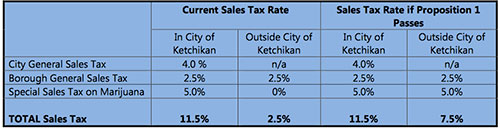

In addition, voters in the City of Ketchikan will have the opportunity to vote for three candidates in a non-contested race for City Council and one ballot proposition which if approved by the voters would allow the operation of transportation network companies such as Uber in the city limits of the City of Ketchikan. There are 6 candidates running for three, three-year term seats that are open on the Ketchikan Borough Assembly. The candidates are Amanda (AJ) Pierce, Alan Bailey (running for reelection), Kevin Gadsey, Joel W. Jackson, Kent L. Colby and Susan Pickrell. Three candidates are running for the two seats open on the Ketchikan School Board for three year terms. Candidates are Diane Gubatayao, David Timmerman and Glen Thompson. Two candidates are running for the one seat open on the Ketchikan School Board for a one year term. Candidates are Bill Blankenship and Glenn Brown. Borough voters who live within the boundaries of the City of Ketchikan or the City of Saxman will vote on additional races. There are 3 candidates running for the three, three-year seats open on the Ketchikan City Council. The election is uncontested. Running for reelection are Dick Coose, Mark Flora and Dave Kiffer. On August 21, 2017, the Ketchikan Gateway Borough Assembly adopted Ordinance 1839-Substitute-Amended, which established a 5 percent areawide special sales tax on marijuana and marijuana products. The special sales tax would be in addition to the Borough’s areawide sales tax of 2.5 percent. Thus Proposition 1 is on the Ketchikan Borough ballot. Marijuana sales within the City of Ketchikan would be subject to applicable City of Ketchikan sales tax rates. The City currently levies a special 5 percent sales tax on marijuana and marijuana products as well as a 4 percent general sales tax. Ordinance 1839-Substitute-Amended provides that the amount of the City special sales tax on marijuana is deducted from the Borough special sales tax on marijuana sales within the City of Ketchikan, up to a maximum of 5 percent. If approved by the voters, the special Borough sales tax on marijuana would become effective January 1, 2018. Unless extended by Borough voters, the tax would expire after five years. Proceeds of the tax would be placed in the Ketchikan Borough’s General Fund and would be appropriated by the Borough Assembly on an annual basis as they see fit. If Proposition 1 passes, the Ketchikan Borough would levy a special 5 percent sales tax on marijuana and marijuana products with an offsetting credit for special sales taxes paid on such sales within the City of Ketchikan. In summary, Marijuana sales are currently subject to a 2.5% general sales tax rate outside the City of Ketchikan and a total sales tax rate of 11.5% within the City of Ketchikan. Adoption of this proposition would adjust those rates to a total rate of 7.5% outside the City of Ketchikan and retain the total sales tax rate of 11.5% within the City of Ketchikan.

The Ketchikan Borough estimates that the tax would generate approximately $30,000 to $50,000 annually. Legalized marijuana is a new industry in the Ketchikan Borough, and firm estimates of sales and tax revenue are unavailable by the Borough. The revenue from the tax would not be restricted for a special purpose. If this proposition fails, the Ketchikan Borough would not collect a special sales tax on marijuana and marijuana products. These products would continue to be subject to the current Borough sales tax rate of 2.5 percent and the Ketchikan Borough General Fund would forgo the estimated annual revenue stream of between $30,000 and $50,000 collected through the tax. City of Ketchikan voters will consider Proposition 1 on their ballot. This is on the ballot because the City Council for the City of Ketchikan passed Ordinance No. 17-1855 which would prohibit transportation network companies such as Uber or Lyft from conducting activities with the city limits, meaning any person or entity that uses a digital network to connect Transportation Network riders with Transportation Network drivers who provide prearranged rides. (Prearranged rides does not include car poor or van pool arrangements or transportation using a public vehicle for which a taxicab certificate of public convenience or public vehicle certificate has been issued by the city.) Alaska lawmakers recently passed legislation that allows ride-hailing companies to operate in Alaska and with a stroke of the pen in June 2017, Governor Bill Walker made Alaska the last state to allow Uber and Lyft. If Proposition 1 is passed by City of Ketchikan voters, transportation network companies like these will not be allowed to operate in the City of Ketchikan. The Alaska legislation provides that a municipality may by ordinance ratified by the voters at a regular municipal election prohibit transportation network companies for conducting activities within the municipality. A YES vote on October 3, 2017 will prohibit the operation of transportation network companies such as Uber within the city limits of the City of Ketchikan. A NO vote will allow the operation of transportation network companies such as Uber in the city limits of the City of Ketchikan.

On the Web:

Representations of fact and opinions in comments posted are solely those of the individual posters and do not represent the opinions of Sitnews.

|

||||