|

Money Matters Reaching Your Most Important Financial Goal: A Comfortable Retirement June 25, 2012

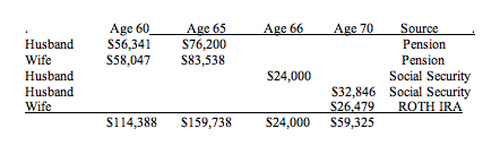

(SitNews) Ketchikan, Alaska - How can you determine whether or not you will have a comfortable retirement? As practical as this question would seem to be, most people are not able to answer it clearly. This column offers an example that will illustrate the process of actually calculating the income that will provide that comfort, or not, depending on your situation. Knowing this information, in advance of retiring, is critical to reaching your financial goals, so read on and take note. This is Case Study #1, Mr. and Mrs. Employed. Mr. and Mrs. Employed are ages 54 and 55. Both are employed and they have no dependent children. Mr. Employed earns approximately $81,000 gross wage and Mrs. Employed earns approximately $84,000 gross wage annually, for a total of about $165,000 combined, before taxes. Their total routine household expenses average about $6,000 per month, not including their mortgage payments of $1,146 per month, or vacations, which generally cost them about $7,000 per year total. They have medical insurance with a $500 family deductible, paid for 100% by their employers. They have a family savings account in the credit union with about $10,000 in it. He is employed by a firm that provides him with a pension that will pay him a monthly benefit at age 60, at the earliest. He has contributed to Social Security all of his working years and will be eligible for full retirement benefits at age 66. She is employed by a state government which provides her with a pension that will pay her a monthly benefit at age 60, at the earliest. She is not eligible for Social Security benefits as her employer opted out years ago. They own a home which is valued at $310,000, purchased for $240,000 with a 30 year-fixed-rate mortgage at 4% and 7 years remaining on the loan, with a balance owing of $83,826. Their monthly payment, not including taxes and insurance, is $1,146.00 (rounded). They have no other debts and they pay their credit cards in full each month. Mrs. Employed has a ROTH IRA worth about $132,000, which is invested in 3 mutual funds. She is currently adding to these funds monthly at $135 each. Mr. Employed does not have a ROTH or IRA of any kind. Instead, he has purchased an undeveloped waterfront lot for $80,000 which he values today at $150,000. It is paid for. Mr. and Mrs. Employed are undecided as to the future purpose of this lot, but have discussed selling their current home at retirement and building a smaller home on the waterfront lot at that time. QUESTION: If the Mr. and Mrs. Employed continue working at their present jobs and retire at age 60 as planned, will they be “comfortable” in their retirement years? How much income will they have to live on for the rest of their lives? Would they be better off to work until age 65? Should Mr. Employed begin Social Security at age 66 or wait until age 70? When should Mrs. Employed start withdrawals from her ROTH account? ANSWERS: Mr. Employed began working for his employer at age 30, so at age 60 he will have 30 years of service and will receive about $56,341 in annual pension benefits. If he works to age 65, his benefit will max at about $76,200. He will not be able to start full Social Security benefits until he is age 66. Taking reduced benefits at age 62 would cost him a 25% loss in benefits. Waiting until age 70 to take benefits increases his benefit by 8% per year waited; this is called “Delayed Retirement Credits” (DRC). Mrs. Employed began working for her state employer at age 28, so at age 60 she will have 32 years of service and will receive about $58,047 in annual pension benefits. If she works to age 65, her benefit will max at about $83,538. She will get no Social Security benefits at any age. Her ROTH IRA, if it grows at an average annual return of 5%, with additions of $135 per month to each of the 3 mutual funds, will be worth about $196,667 by the time she reaches age 60. She can begin tax-free withdrawals from her ROTH account at that time, if she chooses to do so, but is not required to do so at any age, per ROTH distribution rules. An estimate of retirement income alternatives at ages 60, 65, 66, and 70 is: Summary: If they both retire at age 60, their combined income, from pensions alone, will be If they both wait until age 65 to retire, their combined income, from pensions alone, will be $159,738. This amount will not increase over time. If Mr. Employed begins Social Security benefits at age 66, he will receive an annual income benefit of $24,000, on top of their pension incomes. This amount will increase over time. If Mr. Employed delays Social Security benefits until age 70, he will receive an annual income benefit of $32,846, on top of their pension incomes. This amount will increase over time. If Mrs. Employed delays withdrawals from her ROTH until age 70, she will receive annual income of $26, 479, on top of their pensions and Social Security income, and will preserve the principal of the ROTH account (as a hedge against future inflation or emergencies). This amount can increase over time if desired. So, will this couple be “comfortable”? Probably, but that will really depend on how long they live. Every retiree is at risk to live longer than their money does, because of inflation. If inflation averages 4% per year, in just 18 years, a dollar will lose half of its value. The average life expectancy is between age 78 and 82, so someone who retires at 60 will be only 78 in 18 years, and runs the risk of living into his or her 80’s and 90’s. Inflation is the biggest risk faced in retirement, so if their pensions do not have a cost of living adjustment (COLA) provision, they will eventually have less and less to live on. Social Security does currently include a COLA, and the ROTH account can easily be managed to provide a COLA if it is wisely invested. The key is to have at least part of the assets that produce retirement income be protected against the long term damage of inflation. With fixed dollar pensions, this is especially critical to retirement security. Bottom Line: without some planning and simple number crunching, being “comfortable” during retirement is guesswork, a gamble every retiree is wise to avoid. The planning shown in this example removes the guesswork and is great preparation for a secure retirement.

Mary Lynne Dahl, CFP® is a Certified Financial Planner ™ and partner in Otter Creek Partners, a fee-only registered investment advisor firm in Ketchikan, Alaska. These articles are generic in nature, are accepted general guidelines for investment or financial planning and are for educational purposes only.

|

|||