An editorial / By Dale McFeatters Scripps Howard News Service September 14, 2009

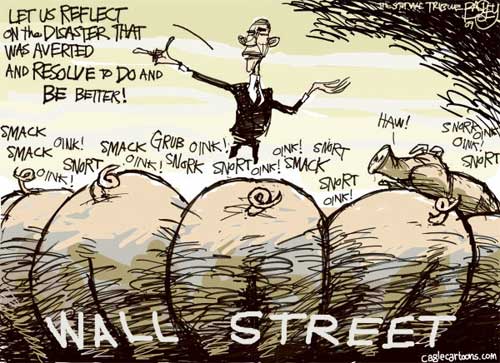

Or else what? A year ago was the nadir of the financial meltdown. Lehman Brothers went bankrupt. So did Washington Mutual. There was the fire sale of Merrill Lynch and Bear Stearns. The massive bailout of AIG. The government takeover of Fannie Mae and Freddie Mac. As Obama noted, $5 trillion of American household wealth evaporated in just three months.  By Pat Bagley, Salt Lake Tribune Distributed to subscribers for publication by Cagle Cartoons, Inc. The outgoing Bush administration and the incoming Obama administration vowed never again. We had learned our lesson. Yet few of the promised financial reforms are in place. The Consumer Financial Protection Agency -- which was supposed to be designed to protect borrowers against hidden fees, surprise penalties and deceptive language -- is still a problem. International agreement on new capital requirements is not expected before the end of 2010 and the new rules are not expected to go into effect until two years later. Obama told Wall Street not to "expect that next time, American taxpayers will be there to break their fall." The Federal Reserve is still waiting for broad new powers to combat "systemic risk" including resolution authority, the power to liquidate in orderly fashion a financial institution that is too big to fail before it does. In the meantime, Wall Street is recovering its animal spirits and appetite for risk. The profits of the five biggest banks are back close to where they were in 2007, the last good year for the economy. And three banks that are arguably too big to fail -- JPMorgan Chase, Wells Fargo and Bank of America -- are bigger than ever, holding 30 percent of Americans' bank deposits. Wall Street has amazing recuperative powers. Financial institutions are again casting around for exotic financial products to sell. Here's one of the latest: Bundling life insurance policies that people have sold to raise cash into huge packages and then slicing them up into securities and then selling them to investors. If this sounds amazingly similar to what happened with home mortgages, it's because it is. What happens when the market for these products dries up as it did for mortgage-backed securities? The answer is: Here we go again. Obama should be prepared to

back up his tough talk to Wall Street. Distributed to subscribers for publication by Scripps Howard News Service, http://www.scrippsnews.com

|

||