By Bill Steigerwald September 22, 2008

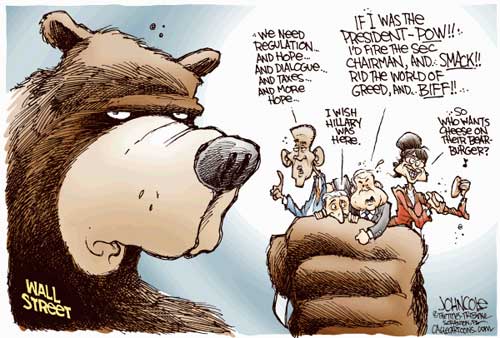

I talked to Burnett by telephone at 3 p.m. Thursday as stocks were soaring on word that the federal government was going to create a special entity that would handle the huge real estate debt that has brought down major financial institutions and created a crisis on Wall Street:  RJ Matson, The St. Louis Post Dispatch Distributed to subscribers for publication by Cagle Cartoons, Inc.

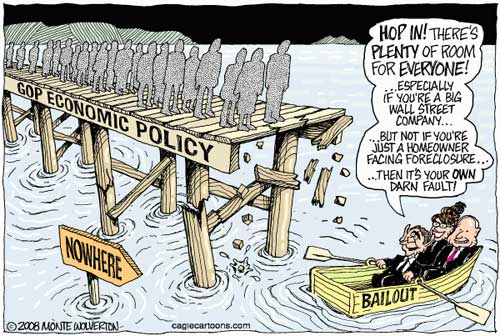

A: It depends on who you ask. For many market players, this is a 9 or 10 event. You continue to see headlines discussing this as the worst crisis since the Great Depression. Some people would even say it's the worst crisis since 1907, so if you think about it that way, you have to say it's a 10. If you look across America, which is something I've been spending a lot of time doing with CEOs of regional banks who can speak for one bank or up to 1,000 banks, there is a slow economy. That is a broader fundamental issue. But in terms of whether these banks are operating, able to get money, able to lend money, able to consider bringing in new customers and funding new projects, their answer is, "Yes, they're able to do all those things." So on that Main Street level, things have gotten worse, there are some real concerns, but it is most certainly not a 10. I don't know what it is, but let's call it a 5 or a 6.  Nate Beeler, The Washington Examiner Distributed to subscribers for publication by Cagle Cartoons, Inc. Q: What is your sound-bite answer to a typical stockholder or nervous 401(k) owner who asks, "What the heck's going on?" A: Over the past few years, money is like water. There was a lot of money and that money helped big institutions lend money to all sorts of people, including regular Americans. That's why mortgage rates were absurdly low and people could buy bigger homes than they ever thought they could buy for no money down. It's all part of the same story. Money was easy to come by and so it was very easy to borrow. What happens for an individual homeowner or an overall economy is that at one point people start to look and say, "Wow! Should I really be lending money to this person? Does this really make sense?" And money becomes a little bit more expensive. Interest rates go up a little bit. That's where we are seeing the strain now. It's lax spending and you've got to pay the piper some day. You go to a party and you binge. You eat the corn dogs and pigs in a blanket. You drink the cider, you drink the wine, you have the vodka. But you wake up the next morning and you feel pretty awful. That's where we are right now. Q: To paraphrase John McCain, are our economic fundamentals sound? A: Nora O'Donnell asked me that the other day on MSNBC right after McCain made that comment about the fundamentals being sound. It's a refrain that Treasury Secretary Henry Paulson has used, the president has used, but a lot of people roll their eyes at. They're wrong in the sense that incomes by any fair measure have not grown for average people over the past eight years; certainly they have not outpaced inflation. Home prices over the past couple years have fallen sharply -- 15 percent over the past year. And we have been losing jobs in this country for the last five months. So in that sense you could say that the fundamentals are not strong. But, if you compare job loss now in this particular slowdown to job loss in a normal, "standard" recession, we're not losing that many jobs. We'd be losing a whole lot more in a standard recession. So things could be worse. But in terms of the fundamentals, I would say they are strong. America gets most of its jobs from small businesses. Those small businesses are small companies, family-owned companies across the country that create most of the jobs and they really create the entrepreneurial spirit that makes this country the place a lot of people want to move to because they think they can fulfill their aspirations and their ambition. In that respect, the fundamentals are strong. That's what makes America the envy of people around the world. I have spent a lot of time over the past year traveling to the Middle East and India and Africa. Even in Libya, where I was last weekend and where there is an ingrained dislike of the United States on one level, there is such amazing admiration for our financial system. That's pretty invigorating. On that level the fundamentals are strong. That may not be specifically what John McCain was referring to, but I can tell you that he is both right and he is wrong.  Monte Wolverton, Cagle Cartoons Distributed to subscribers for publication by Cagle Cartoons, Inc.

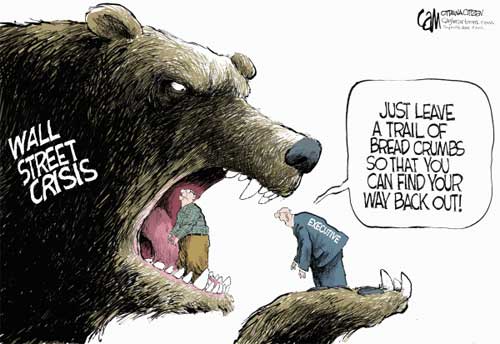

A: I wish I knew the answer to that one. Last fall everyone thought that the next shoe to drop was a billion-dollar write-down from a bank. Those were the big things that were causing such huge concern and fear. Then when Bear Stearns happened, everyone thought that was the final shoe. And then this summer happened and you had Fannie and Freddie and then a week later you had Lehman Brothers and Merrill Lynch. And now you have aggressive stock price drops for the two remaining independent investment banks (Morgan Stanley and Goldman Sachs). Nobody knows what the next shoe is and I think that's the fear. It could be a commercial bank. It could be one of those investment banks. It might not be anything. But it is that fundamental uncertainty that's really causing the system to freeze up. Q: Where should people put their money? Should they keep it under their mattress, put it in a CD or what? A: That's a tough one. One of the things to emphasize to people is there are significant investment protections in place in this country. There are federal protections in place for people who save money -- we all know about the FDIC. There are also protections in place for investors through what is called the Securities Industry Protection Corp., the SIPC. If you have a brokerage account and your broker fails, they must give you back everything in your account -- and they usually do. If there is a problem with that or fraud, the SIPC will step in and people will get their money back usually up to half a million dollars. Insurance is regulated (by states) across the country, but there are also protections in place for that. The thing I would emphasize is that there are protections in place. Generally speaking, you are protected. The one thing nobody can protect you against is a big drop in market value; there's no protection in the world that can help you from that. If you really think the market is going to keep crashing, maybe you would take your money out. But at this point, if you have gotten this far, you potentially run the risk of being one of the people who run out of the market and then you just might miss the big bounce, which is what happens to retail investors all the time. I'm not recommending anything specifically. But if you have a long-term plan, you might want to stick with it. I will say this: Talking to hedge fund managers, talking to pension fund managers, they all tell me that they see a lot of opportunity right now. So there will come out of this probably some of the most amazing buying opportunities in a long time. Good luck finding them.  Cam Cardow, The Ottawa Citizen Distributed to subscribers for publication by Cagle Cartoons, Inc.

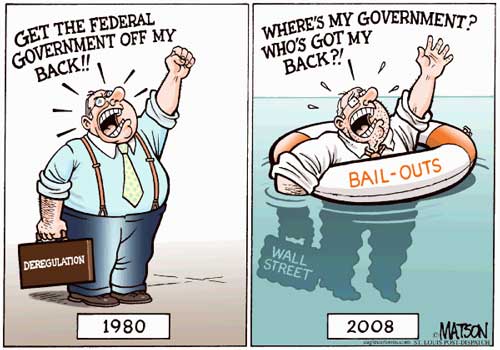

A: I don't, and I'm not saying that to be coy. I don't believe anyone knows exactly who is to blame. I think that is because a lot of people were to blame. Fundamentally, greed was to blame. A lot of people at a lot of different institutions in a lot of different roles -- at banks, at hedge funds, regular investors, home buyers, regular people across the country -- were greedy. People thought that they could invest their money and it would be guaranteed to go up. The most sophisticated investors and regular homeowner people went out and took out these loans that frankly if they had been really looked at they would have realized they couldn't afford to. Home prices have never gone up 50 percent a year, and suddenly people started to think that was acceptable. Or even 10 percent a year was acceptable. Those things, if we had really looked honestly -- any of us -- at ourselves in the mirror, we would have known that was impossible. So in a sense, everybody is to blame. That's my big-picture answer. On a more specific level, certainly there was some real failure in the regulatory system. That doesn't mean we need to regulate more. It just means the regulation wasn't appropriate for the financial innovation that was out there. The lending was lax. Banks were giving loans to individuals and companies that shouldn't have gotten them. And the people taking out those loans were not being responsible in many cases. You can't really just say, "Oh, it's the regulators' fault. If we had regulated it right everything would have been fixed. Or if we put all these restrictions in place. If we didn't let people short-sell everything would be fine." All of that is too simplistic to blame the entire crisis on.

John Cole, The Scranton Times-Tribune Distributed to subscribers for publication by Cagle Cartoons, Inc. Q: Is there a political solution to this crisis or is it a matter of letting the economics and financial conditions play out? A: The RTC thing in a sense would be political. It would involve the government. When you have the financial system as a whole truly at risk, it's hard to imagine really not having the government involved. A lot of people who would be as free market as one could be are holding their nose and saying Hank Paulson did what he had to do. There's no question we have just seen the greatest increase in government involvement in capitalism that we've ever seen, frankly, and that many people would have a real ethical problem with -- and not just ethical, might believe it would cause markets to operate inefficiently over time. But if you're the treasury secretary and you realize you are going to end up with potential financial Armageddon, you have to do what you have to do. So I think it is very hard to be critical of Treasury Secretary Paulson. I think most people on Wall Street would say, "Thank goodness he's there." He understands these companies. He knows how they operate. He knows how they make money. He understands the product they offer. That says a lot. I think a lot of people are very grateful that he's there. They may wish that some of these decisions that he's been forced to make don't end staying with us forever -- like nationalizing insurance companies or nationalizing home ownership. It's hard to judge if you can't come up with a better way of having handled the crisis when the crisis actually struck. Maybe if we'd made different decisions years ago we could have prevented it. But certainly over the past six months it's hard to imagine what could have been done specifically to completely avert the crisis that didn't involve the government in any way shape or form. The one thing that I would say that our constituents and that I believe is that government may need to be involved, but you want them to be involved in the smallest possible way they can be involved to help fix the problem. That's what you want it to be. Getting that balance right is not necessarily easy, I recognize that. You certainly don't want the government telling capital where it should be allocated. People who have expertise in capital are the best people to make that decision. Q: The Wall Street Journal says there's no end in sight for this crisis. How long do think it will last? A: In terms of the immediate

crisis right now, this sort of not knowing what is going to happen

every day -- and whether you are going to have to work 48 hours

through the weekend at the Treasury Department and have another

bailout or a crisis -- that, hopefully, will start to calm a

bit. But the broader issue -- the long-term change in lending

standards, where it might be harder to borrow, where you might

have to put more money down, etc., -- is probably going to last

a long time. I don't know how long, but I can tell you that the

guidance I get from CEOs in the housing industry and the banking

industry is that it is likely at least to the end of next year

and probably well into 2010.

E-mail Bill at steigerwald@caglecartoons.com ©Pittsburgh Tribune-Review, All Rights Reserved. Distributed exclusively by Cagle Cartoons, Inc. to subscribers for publication.

|

||