By Bill Steigerwald July 22, 2008

Q: Oil prices have taken a nice dip and stock prices are jumping. Is the worst over for the economy? A: Who knows? The decline in oil prices is probably a sign that the oil market recognizes that the world economy is slowing. Despite all the talk about speculators, the facts about the oil market are very simple: The demand has been about 1 million barrels a day more than the supply. Demand has been increasing and the supply has been falling. So you don't need to blame speculators to get a story about why the prices have been rising.  By Adam Zyglis, The Buffalo News Distributed to subscribers for publication by Cagle Cartoons, Inc.

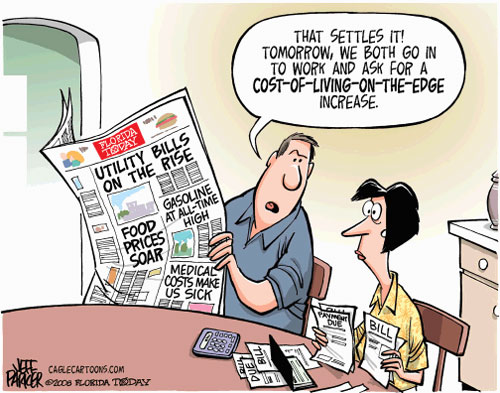

Q: And stocks moving up is not the start of a big trend? A: A lower oil price does help. Despite all the talk about the housing market -- and the housing market is in many locations a serious problem -- it is not the major problem, as far as I can see. The major problem for the economy is that people are really pushed against their budgets to pay for gasoline and food, which have risen. Oil prices get into every product we buy; every product moves by truck or airplane, and those industries are seeing serious cost increases. So prices are going to rise for transportation, and that affects everything we buy. Wait until we see what is going to happen to the home heating-oil prices of people who use oil to heat next winter. It's summertime now and, of course, they are running air-conditioners. But there's going to be a real problem in the winter in New England and the Midwest with oil prices for home heating. Q: Do you see the high prices of energy as temporary or permanent? A: This is not a temporary problem. It's a long-term problem. It's been a long-term problem. It's occurred a couple of times. The Congress and I think about seven administrations since Richard Nixon, including Richard Nixon, have done very little to protect the United States against the problem. I have argued for several years that the argument between those who think that we need more oil and those who think that there are environmental problems should not be the main argument. And now people are coming around to the view, which I've held for a long time, that this is a serious national security problem, because the money that we spend for oil is going to people who don't like us for the most part -- Venezuela, Iran. We are helping to finance the building of the atomic arsenal in Iran. We are financing the Saudi Arabians, who are building mosques all over the world to preach hatred of the United States. And that's what they do. Years ago, I was in Albania. The only new buildings in the country at the time were mosques, paid for by the Saudis, spewing hate. Q: When we talked in August last year, you said that the world economy was in pretty good shape. What's gone wrong since then?  By Jeff Parker, Florida Today Distributed to subscribers for publication by Cagle Cartoons, Inc.

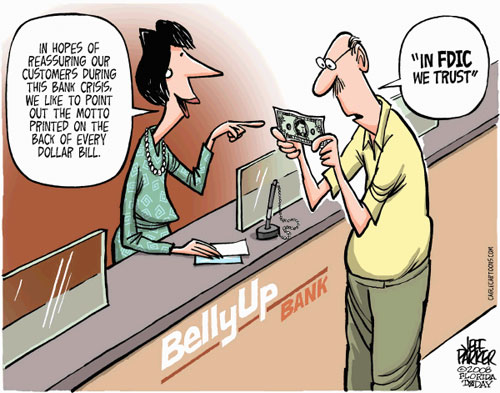

Q: And you were right on both of those counts. A: Yes. And not only did they make a mistake but they have put themselves in a position where they don't want to change before the election; and so we're going to stay here. We're not going to see much happen on the monetary side, and the housing problem, that gets so much attention, is a very localized problem. It affects many people in many places, but the serious damage is located in six locations. Even people in Los Angeles, which is one of the markets that is badly hit, it isn't really in Los Angeles. It's in the area of Los Angeles. The houses that are having a problem are 25 or more miles from Los Angeles. They are in Riverside County and San Bernardino County, where the land was a bit cheaper, so they could build these houses and hoodwink people into thinking that they would not have to pay for them. Q: Is the U.S. economy in serious trouble or are we -- the media and politicians -- focusing too much on the negatives? A: We are having serious problems. But there isn't much that the Congress can do that is going to be helpful in the housing problem. I say that with all due regard for the problems of the people who are being pushed out of their houses. But the fact is that those house prices got to be extraordinarily high and they are coming down now. It's important that they come down.  By John Cole, The Scranton Times-Tribune Distributed to subscribers for publication by Cagle Cartoons, Inc. The reason the financial markets are not operating very well is because nobody knows what the value of the mortgages on those houses are -- and those mortgages are mixed up in bundles of mortgages, so they don't know what the bundles are worth. And they won't know what the bundles are worth until they have a good idea of what the underlying houses are going to be worth. Once they get a clear idea as to how far the house prices are going to fall, then they'll be able to value the mortgages. And then the financial markets will gradually begin to return to some kind of normal operating condition. When Congress goes out and says, "We're going to protect them" and "We're not going to allow housing prices to fall," they are delaying the solution to the problem. It's sad but true, but the adjustments have to take place. Q: What economic or financial "thing" should Americans be most worried about right now -- housing, the cheap dollar, inflation? What's most worrisome? A: Well, inflation and the cheap dollar are of course two sides of the same coin. The reason that the dollar is falling is because the U.S. is inflating and so people who hold dollars are getting less real value; so those two things go hand-in-hand, and those are serious problems. The most immediate problem for many people will be the possibility that banks are loaded up with debt that may not be paid. Therefore there will be bank failures. We saw one in California this week but many people expect that there will be others and the uncertainty about that makes people hesitant to do much.  By Jeff Parker, Florida Today Distributed to subscribers for publication by Cagle Cartoons, Inc.

A: Well, what they are mostly doing is what they do most -- and that is, fighting with each other. What are they doing that's correct? Well, it's hard to say that rescuing Fannie Mae and Freddie Mac was a good thing, given that the Congress sat for 20 years and put off doing anything about the problem; but eventually the problem became severe and they have to do something about it. I guess you would call that a good thing. What they need to do is pursue a policy which aims over the next two or three years. They can't do much about what is going to happen over the next six months or even the next year. But they can do things which will make the world and the United States a much better place two or three years from now ... . How can they do that? Well, one way to think about the problem is to think this way: The oil price increase is a tax which we pay to foreign governments. We don't get the spending benefit. They get the spending benefit and we pay the tax. So if we want to do something that would be helpful, we could reduce domestic taxes to compensate for the tax we are paying abroad. That would make consumers whole, or nearly whole. It would also help to cut business taxes, because they are bearing big price increases. Dow Chemical announced it's raising prices 20 percent. I was with some businessmen. One of them has four companies in China and he said they are raising their prices a minimum of 20 percent. Those are going to hurt. So we can help consumers and business by reducing their tax burden by something to offset the oil increase. I'm a strong believer in nuclear power. We're not going to get it tomorrow but we're not going to get it at all if we don't start. If we had started it 10 years ago, we'd be getting it now. So the argument that people in Congress make that says, "Well, we won't get any benefit from drilling in the Atlantic or the Pacific for years" -- well, that's true. But if we started years ago, we'd be getting it now. And if we start now, we'll eventually be getting some help. It's absolutely wrong to say that because we won't get the oil for five years, we won't get any benefit now. The future price will go down. And if the future price goes down, the spot price will go down, too, because on average the spot price -- the current price -- and the future price are going to differ by interest rates and the cost of storing oil. So one comes down, the other comes down. Q: They work together. A: Yes, they are tied together. Let's say the future price goes up. Well, then people say, "If I move some oil from present to future, I can benefit from that rise." That raises the spot price. And the same thing works in reverse. Q: How confident are you that the same people who got us into this mess can get us out without merely pushing all our problems farther down the road? A: Not confident at all. I think we ran a very sensible monetary policy from about 1985 to about 2002. We had long periods of expansions with very small recessions. We've given that up and the Fed has gone back to doing the silly things it did in the 1970s -- being too concerned about the possibility of recession, thinking that the inflation will be put off, and all that. That was a mistake in the 1970s and it's the same mistake they are making now. I don't have a lot of confidence in what they are doing. Now there are plenty of them who are there who agree with me. I'm sure of that, and some of them dissent at every meeting. But the leadership has been on the wrong track. Q: And this is a political problem? A: As much as anything, yes. The word "policy" and the word "politics" have the same Greek root. You don't get one without the other. Q: What should the average American newspaper reader or TV watcher keep his eye on that would be a good signal to him that we are heading in the right direction again? A: Once he sees that housing prices fall and are approaching a bottom, things will begin to get better.

E-mail Bill at steigerwald@caglecartoons.com ©Pittsburgh Tribune-Review, All Rights Reserved. Distributed exclusively by Cagle Cartoons, Inc. to subscribers for publication.

|

||