Fair vs Unfair SolutionsBy Ghert AbbottAugust 14, 2018

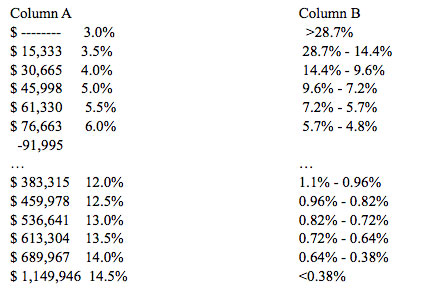

The extremely wealthy have vastly different priorities than ordinary people; they do not rely upon public services like working and middle class Alaskans do. The lives of the rich are not negatively impacted by cuts to public education, by cuts to the state university, by cuts to healthcare, by cuts to the pioneer homes, by cuts to transportation infrastructure, or by cuts to public safety. Their vast wealth shields and protects them from the horrific social consequences of cutting these services. Rather, such service cuts enormously benefit the affluent, as it lowers their present and future tax bills. The rich can thus become richer by making everyone else effectively poorer. It’s the same with taxes. Progressive taxation, where one’s tax rate scales with income, is intensely hated by the rich. They much prefer regressive systems that shift the burden to the people beneath them: head taxes and sales taxes. In Column A are the bottom six and top six 1975 Alaskan progressive income tax brackets for a couple with two children. In Column B are the effective PFD tax rates for those same couples, assuming a $1,100 tax of a $2,100 dividend. Notice how much an ordinary working and middle class Alaskan family pays under the PFD tax compared to the 1975 progressive tax. And compare how little a wealthy family pays under the PFD tax compared to what their tax rates would be under the 1975 rates.

When you combine these effective PFD tax rates with cuts to essential social services, the results are the entire fiscal crisis being placed upon the backs of ordinary Alaskan families. Is that fair? Ghert Abbott,

About: Ghert Abbott was born in Ketchikan in 1986 and is a graduate of Ketchikan High School and the University of Alaska Southeast-Ketchikan. He is the Democratic candidate for House District 36’s legislative seat.

Editor's Note:

Received August 14, 2018 - Published August 14, 2018 Related Viewpoint: Viewpoints - Opinion Letters:

Representations of fact and opinions in letters are solely those of the author. E-mail your letters

& opinions to editor@sitnews.us Published letters become the property of SitNews.

|

||