No Property Taxes in the City of Craig? A Referendum May Make this a RealityBy ARTHUR MARTIN

August 08, 2018

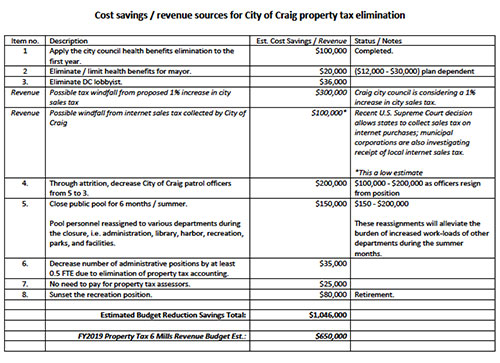

Property taxes have been a standard way for cities (and boroughs) to get revenue for hundreds of years and is a relatively simple formula: x amount of houses multiplied by x amount of 'mills' per house value = your property tax revenue. The 2019 estimated revenue for the City of Craig, for example, based on '6 mills' is about $650,000. For a small city like Craig, which has an average budget of about $3 million, this is a substantial amount of money for the city to continue and function at its current rate. Unlike, many cities through out the country, the City of Craig has been successful at balancing it's budget for at least a decade and not having to take out substantial loans to make up shortfalls. ‘The millage rate in local government language is synonymous with the property tax rate. “Millage” is based on a Latin word that means “thousandth.” So 1 mill is equivalent to 1/1000th. Applied to taxes, that means 1 mill is equivalent to $1 in taxes per $1,000 in taxable value. If your property has a taxable value of $100,000, and you’re assessed a 1 mill tax rate, you’ll pay $100 in taxes. The standard way to figure your actual tax bill based on the millage rate is to take that rate, multiply it by the taxable value of your property, then divide the result by 1,000. (1.)’ The controversy that is at play (should this referendum actually pass by the voters) is, 'Will the City of Craig actually be able to operate normally?' The answer is simply no. Attached below is Andy's budget proposal for the future should the taxes be cut and it's a humbling proposal; it will cut the police department from 5 to 3 officers, shut down the swimming pool for half the year, eliminate a couple of city jobs, and cut health benefits for the city council.

Having a city operate without collecting property tax isn't a new concept either, for example, the cities of Klawock, Thorne Bay and Coffman Cove on Prince of Wales Island rely primarily on sales tax and do not impose a property tax. The difference between these towns and Craig, is that Craig is considered the 'hub' of the island with the biggest high school (that students from these areas shuttle to), a pool, and a large community gymnasium that doubles as a host for many community events. In a letter that Andy and Lisa sent out titled, '10 Good Reasons to Repeal Property Tax in the City of Craig' they address some of the more common criticism to their proposal (2.): ‘1. True land ownership: Without property tax, people can actually own their land and homes without threat of tax forfeiture. Property tax makes land ownership impossible – “rent” must be paid to the city corporation in the form of property tax or the land is forfeit. 2. School funding: A common misconception is that property tax is required to pay for schools. This is false. First class cities are required to fund their schools, by whatever funding source(s) they wish, no less than 2.65 mills of the assessed value of property within the municipality. Without property tax in Craig the amount of school funding can continue as before. 3. Outside money inflates real estate prices: In areas subject to property tax, a common problem arises when outside money inflates property values. Local families and small businesses on a limited income or fixed retirement income can be forced to pay exorbitant property taxes when property values become inflated, sometimes forcing them to leave the area. With no property tax, any increase in property value is seen only as a positive to landowners. Your children need not worry about losing the family property because they cannot pay the taxes.’ Your humble journalist did reach out to a couple of Craig residents asking for their opinion on the petition, One property owning resident was against the petition saying, 'we all have to pay our fair share and while I don't use the pool and never have and my kids are full grown adults, what I don't like is someone like Andy coming along, who doesn't have property and doesn't pay any real taxes, to dictate to long-time residents what should or shouldn't happen in this city.... and a functional town should have things like a library, a pool, and a fully funded school even though I don't use these services but the entire Island does benefit from these things.' Another quipped, 'Govt’ and the taxes it needs to exist and are necessary evils. The desired goal is, Better govt’ not more govt...Our swimming pool does not pay for itself. But if one child learns to swim in our pool and then doesn’t drown when they fall overboard it is worth it. When our seniors get much needed exercise in the pool and stay alive to see that kid who survived his fall over board, it’s worth it.' A long time resident with kids wrote, 'The other night we had to dial 911. The amazing thing is… Somebody answered! Not only did somebody answer, but within 2 minutes we had an EMT at the house. Praise God it wasn’t life and death. I understand that our EMT’s are volunteer, but our tax dollars go to support them. I view myself as a conservative. Although I don’t like the waste I see in our local government, I still believe that everybody who may need to utilize our public services (Police, fire/rescue, and EMT) should help pay for them. I am not opposed to the elimination of property tax in Craig, to be realistic we need to have something to replace it with. Does that look like a higher sales tax? Probably not. To be honest it would be the same burden on those paying property tax, unless the sales tax was increased during peak fishing and tourism season. There is no simple answer.' Right now Andy and Lisa are focused on reaching the required amount of signatures to put the petition on the ballot, which equals about 25% of the voters who cast ballots in the last city election which is approximately 76. They write that weather depending they will, 'try to be either in front of the Craig Post Office or the AC Thompson House most days between the hours of 4 and 6 pm.' If approved by the qualified voters at the next regular municipal election or special election, the repeal of Chapter 04, Title 3, Property Taxation, of the Craig Municipal Code shall take effect on July 1, 2025.

On the Web:

Representations of fact and opinions in comments posted are solely those of the individual posters and do not represent the opinions of Sitnews.

|

||||