Alaska Permanent Fund up 4.9 percent

August 24 2015

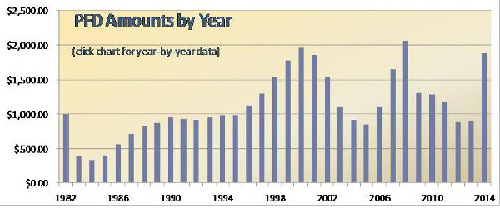

“This was a more volatile year for the capital markets, so we are pleased to be able to report a positive return overall,” said Valerie Mertz, Acting Executive Director. “After two years of rising stock markets, we weren’t surprised to see corrections in the U.S. and overseas markets at the start of the fiscal year. Later rallies helped make up lost ground, but the earlier losses certainly weighed on overall returns. The risk aware approach we take to managing assets helped us to successfully navigate this more difficult market environment.” Click on the graphic for a larger image. The U.S. stock portfolio gained 7.2 percent for the fiscal year, while the non-U.S. portfolio returned -5.2 percent. The Fund’s global portfolio, which contains both U.S. and non-U.S. stocks returned 1.2 percent. Bonds had periods of difficulty over the fiscal year as well, and while the Fund’s U.S. portfolio was up 1.2 percent, the non-U.S. portfolio lost 2.4 percent. Real estate was an area of growth for the Permanent Fund in more ways than one. Not only did the Fund’s investments gain 9.8 percent for the fiscal year, but the portfolio expanded in notable ways as well. The Fund’s long-time investment, Tyson’s Corner Center outside Washington D.C., celebrated the successful grand opening of a sizeable three-building addition, including an office tower, hotel and apartment complex. Finally, the purchase of 50-percent ownership interests in retail properties in Portugal and Spain added to the year-old European portfolio. Private equity was a strong contributor, with the portfolio gaining 16.5 percent over the fiscal year. The Fund’s infrastructure investments were also up, returning 4.7 percent for the period. The absolute return and real return portfolios are comprised of multiple asset types, and returned 1.7 percent and 3.4 percent respectively. Statutory net income is the amount used to calculate the annual Permanent Fund Dividend. The Fund earned $2.9 billion in statutory net income for fiscal year 2015, and transferred $1.4 billion to the Permanent Fund Dividend Division for the 2015 dividend payment. The 2014 dividend transfer was $1.2 billion. Final audited returns will be presented to the Board of Trustees at the Corporation’s annual meeting on September 29 and 30 in Anchorage. Additional detailed information can be found at the following links for the Permanent Fund’s financial statements and investment performance. In 1976, as the Alaska pipeline construction neared completion, Alaska voters approved a constitutional amendment to establish a dedicated fund: the Alaska Permanent Fund. During construction of the Trans-Alaska Pipeline in the 1970's, oil companies flooded state coffers with money paid for leases to explore and secure drilling rights. The Legislature spent all $900 million of that initial lease money within a few years. Alaskans realized that they were about to receive a great deal more money from oil when the pipeline was complete. They wished to better safeguard the robust income forthcoming from the pipeline, but the state constitution did not allow for dedicated funds. So Alaskans voted in 1976 to amend the constitution to put at least 25% of the oil money into a dedicated fund: the Permanent Fund. This would save money for future generations, which would no longer have oil as a source of income. In 1976 Governor Jay Hammond proposed a constitutional amendment to create the Fund. The 9th Alaska Legislature modified the governor's legislation and placed it as a ballot proposition in the 1976 General Election. It passed by a margin of two to one. In 2014, the amount of the Permanent Fund Dividend check was $1,884. The Alaska Dispatch News estimates the 2015 amount to be $2,100. If the ADN extimation is correct, this will be the largest check amount distributed. Each year the PFD amount is typically announced around the last two weeks of September.

Edited by Mary Kauffman, SitNews

Source of News:

|

||