RE: Taxes & Local Govt. By John Harrington June 10, 2013

I hope that your readers are interested in continuing the conversation on taxes and local government, because I am writing again. I wrote the previous letter for three purposes:

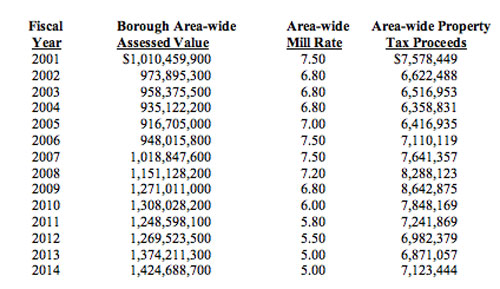

I did not plan to go into detail on the whole range of tax issues; nor did I plan to go beyond the narrow scope of Borough issues—they are the ones I know best. I will leave City tax-and-spend issues to any current or former City Council member who wishes to discuss them. First Topic of this letter: The Borough's mill rate history: Mr. Dial's comment that the Borough taxes have been on the rise, since the time when there was a one mill tax, is obviously correct. He is also correct that taxes were recently able to be lowered because of the increase in assessed valuation. So in keeping with the idea that more information is better, here are those numbers for the last decade or so.

As can be seen, the total assessed value of the Borough went down from 2001 to 2005, and then began to climb again. Total property taxes did not reach the 2001 level until 2007. From 2007 to the present the Mill rate has declined, and after 2009 so have the total tax receipts until 2014. Even with the FY 2014 rise in receipts the Borough will use over $658,000 of reserves to meet next year's budget. No one will dispute Mr. Dial's comment: Citizens have that right. But I think it is worth pointing out some of the broader context. The Assembly cut the mill rate deeper than they cut expenditures. At some point, reserves will no longer support that spending, and taxes will either rise or services will be cut. Could the Borough have done better? Of course, but as governments go, it has performed better than most. Second Topic: School District funding and the effect of the State shifting part of the burden of education on to the Boroughs: The School District is the single largest item in the Borough budget. In previous years the Borough's mandatory portion has ranged from 0 mills to 4 mills. If the District was funded solely out of property tax revenues, the current mandatory contribution would be well over 3 Mills and the voluntary contribution would almost double it to well over 6 Mills. Obviously with a 5 Mill tax, the borough uses sales tax revenues and reserves to help fund the district. If you factor in the cost of debt for school construction bonds the Mill equivalent is in the neighborhood of 7.5 Mills. One of the most exciting aspects of Borough Assembly activities lately is their focus on resolving school funding inequity. If the State were to finally shoulder the full funding of basic education then the Borough would be in a good position to not only continue the downward push on Mill rates, but could even provide more voluntary funding for schools. Third Topic: A follow up on the White Cliff discussion: As I stated before, I voted 'no' on the project. I don't know the reasons why the others voted in favor. Mr. Dial's, beliefs as to their rationale, are possibly accurate for perhaps some on the Assembly; but after having listened to the discussions and participated in the process, I have no idea what the “Whys and wherefores” of those other decision-makers were. I find Mr. Dial's comments about the Mayor curious, and a continuation of the 'character assassination' thingy of his. “... Borough Mayor and his impeccable ethics, you failed to mention how he has done things such as funnel half a million dollars of tax money to First City Players to construct “bathrooms” for tourists in the performing arts center (how’s that project working out?), how he supported consolidation (would have cost us millions), etc.” His comment makes no sense. In my last letter I pointed out that we have a Weak Mayor system. The Mayor was (and is) incapable of funneling money to the Performing Arts Center. That was again, the Assembly's action. If Mr. Dial wishes to identify the person who most pushed for that action, I can tell you all, it was not the Mayor. That person was me! With regard to consolidation, Why does Mr. Dial single out the Mayor? He had far less to do with it than, say, Mr. Painter, Mr. Thompson, or (again) me. Mr. Dial and I battled figures during that election, his side won the election, but I still firmly believe he is wrong when he states, “(It) would have cost us millions.” But it is pointless to continue that old argument. In Closing: At many levels our government is bloated and bureaucratic. It is probably the single biggest threat to our American freedoms, and our American way of life. Cynicism and anger develops as one looks at much that goes on in our government. It is natural for that cynicism and anger to become focused on all levels of governmental actions. So, as you the reader considers our various points of view, I hope you understand that this is a discussion about the minutiae of a local government. The broader goal of restraining big government is important to all of our futures. John Harrington

Received June 07, 2013 - Published June 10, 2013 Related Viewpoint:

Viewpoints - Opinion Letters:

Representations of fact and opinions in letters are solely those of the author. Your full name, city and state are required for letter publication.

|