THE OWNED MANBy David G HangerMay 07, 2018

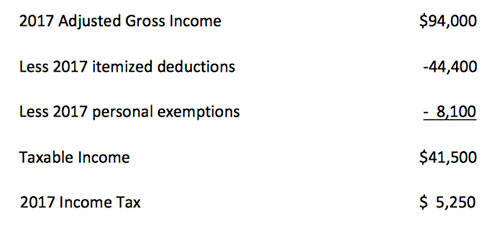

No one likes paying taxes, and no one thinks we are getting what we pay for, but Senator Conoco-Phillips is lying when he claims to be concerned about what you pay in. You are a serf to be exploited for your vote, for your obeisance, for your money, and for your belief in a falsehood promulgated by Mr. Sullivan that letting the super-rich and the donor class run off with all the tax breaks is also a really good deal for you. It is not in any sense a good deal for you; it is a rip-off of insane magnitude. Let us study in detail why what I say is true and factual to the best of my knowledge and belief, in contrast to Senator Conoco-Phillips who cannot begin to claim that for his propagandistic nonsense and his outright lies. Let us begin with what is arguably his most nefarious lie, to wit, “Look what a good guy I am for having doubled your standard deduction on your tax return,” up from $6,350 to $12,000 for single individuals, up from $12,700 to $24,000 for married couples filing a joint tax return. What he has failed to tell you is that he signed off on outlawing the personal exemption a taxpayer receives for himself, his spouse, and his dependents, an amount that totals $4,050 per individual in 2017 and had been projected to go up to $4,100 for 2018 before this mess of a new tax law was passed. The outlawing of the personal exemption amount does a lot more than merely diluting the consequence of what this man brags so loudly about. For a single individual the difference between $6,350 and $12,000 is $5,650; but, having his or her personal exemption outlawed means this amount is no longer claimed, so that amount needs to be subtracted from this benefit of $5,650 in extra standard deduction, i.e. $5,650 minus $4,100 leaves a residual additional deduction for singles totaling $1,550, a long way from $5650. For a married couple with no dependents the $1,550 doubles precisely to $3,100 ($24,000 minus $12,700 minus $8,100 equals $3,100). Woo-hoo. If you haven’t figured the math out yet, it gets a lot worse. What happens if you have a couple kids? For a married couple with two children losing four exemptions worth $16,200 in 2017, and originally scheduled to be worth $16,400 in 2018, the effect is already negative in that the $16,400 in exemptions outlawed offsets the $11,300 in extra deduction gained by $5100, so at the very beginning you are reporting $5100 more in taxable income annually. That will be $9200 more for three children, $13,300 more for four children, and $18,400 more if you have five children. Thus the more children you have the higher your taxable income will be. This is where the crapshoot starts, and it just kind of depends on your circumstances whether you are going to win or you are going to lose under this new tax law for which Senator Conoco-Phillips wants to claim so much responsibility. This is also why I assert he has absolutely no concern about the consequences of this new tax bill to individual Alaskans. What Senator Conoco-Phillips has failed to tell you (quite intentionally) is that a lot of ordinary Alaskans are going to owe a lot more income tax because of this piece of garbage he is bragging so loudly on and about. At the next level of calculation is where the real mickey mouse begins. In all cases there is something of a smoothing effect because of the slightly lower tax rates that will moderate these extremes somewhat, but it is the blunt instrument of using the child tax credit to offset this nonsense that makes so much conditional. By Ivanka’s insistence the child tax credit (CTC) was doubled to $2,000, so in those low-end cases where this tax credit applies most of the tax liabilities will be zeroed out anyway. But that is also true under the old tax system, so nothing ultimately is really gained or lost here. The child tax credit is not available for dependents over the age of 16, so if your kids are in college, slow to launch, or you are taking care of your parents or grandparents I have some very sad news for you. Worrying about a tax increase is a likely concern. Let us look more closely at some real-world examples. First an extreme case, which in fact is quite real, and represents a likelihood to be seen, I would guess, on some dozens to no more than a thousand or two Federal income tax returns filed by Alaskans. This is a case of high itemized deductions and substantial travel as part of those deductions. We have a married couple where all payments are on W2s, and he travels extensively for his job.

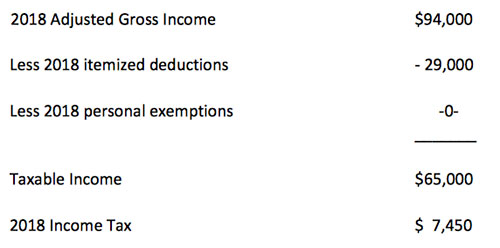

Because of the elimination of the Miscellaneous Itemized Deductions section all travel deductions, union dues, uniforms, safety equipment, supplies, continuing professional education expenses, tax fees, investment fees, etc. have been wiped out by the infinite wisdom of Senator Conoco-Phillips and his cohorts. Using the same numbers for 2018 the tax return would look like this:

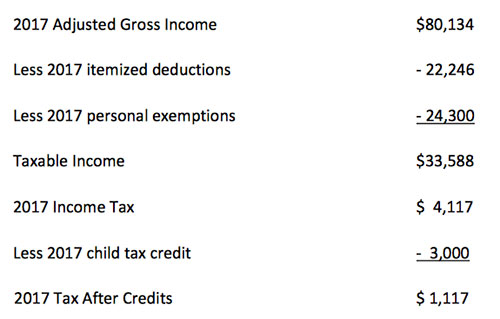

A tax increase for 2018 of $2,200 which is a 42% increase in tax. I reiterate this is a very real case, and is the very real likelihood in 2018. I just don’t know how extraordinary (relative to the main) this case is. We have $15,000 to $16,000 of miscellaneous itemized deductions and relatively high deductions for taxes, interest, medical, and contributions; but in this day and age I do not see that these numbers are all that unusual. I have no idea whether we are talking about dozens or thousands of Alaska cases similar to this, but out of 250,000+ tax returns filed in the state of Alaska a few thousand of these types of cases would not surprise me at all. If you are working on W2s and go to camp, construction work out of town, CPE for teachers, nurses, skilled workers, etc., this so-called “tax cut” is likely to cost you a lot of money. You can argue, for example, that the solution to this is to have the employer pay for the travel, which is often done already; but that does not begin to solve the problem created here. The individual taxpayer will still incur a dramatic increase in income tax liability, and the employer will incur additional hassle, administrative overhead, extra costs, etc. for what will amount to a zero sum game at best for the employer. In addition it pinpoints why a ‘simplified’ tax system is not all that desirable in the first place. It straitjackets human behavior, deprives free Americans of choices they would otherwise create for themselves, and is by its very nature autocratic. A simple tax system probably will work just fine in a society where everyone is expected to conform to an extremely limited array of norms, i.e. a dictatorship like Red China, but such a simple system denies imaginative alternatives, and loopholes are the stuff of free life. A complex tax system in a free society is definitional and enhances freedom rather than detracting from it. In our current example the employer now assumes responsibility for $15,000 a year in travel expenses. In the meantime the Feds collect 42% more in income tax from the individual taxpayers. The employer will need to administer all these new expenses, which obviously has its own costs, so let’s say the employer decides to double his employees up or house them in the CheapSix Motel where you can’t hear the folks through the wall on the right of you because they to the left are already half-way through on the other side. Or maybe you just don’t want to listen to Bob farting and belching and snoring, and Rachel Maddow is his favorite show on TV. This straitjacketing and deprivation of choices stuff can get serious quickly. Being forced into such alternatives by government mandate fundamentally contravenes the phony assertions that Senator Conoco-Phillips insists motivate him. He isn’t giving me more freedom; he is taking freedom from me. Next, let’s study singles at various income levels with strictly linear returns, i.e. no extra deductions or anything else going on; short forms. Proofs have been made available to Mary for anyone interested, so in order to save space just the results. Again, these are patterned after real-world cases. A single individual earning $29,050 in 2017 incurred a tax liability of $1,900. For 2018 the tax on the same circumstances will be $1,856, a whoopee-doo tax savings of $44, or .2%, that is indeed two-tenths of one percent, or 10 times less than is needed to cover inflation at 2% per annum. The indexing in the old tax system would have covered all of this nonsense just fine, and from this example it is safe to say that for single individuals with incomes at least up to $30,000 (and some distance beyond) your tax savings under this new tax law will be nil, and likely will not come close to covering inflation. A single individual earning $67,500 in 2017 incurred a tax liability of $10,008. For 2018 the tax on the same circumstances will be $8150, a savings of $1858 or 18.57%. Here we start to get closer to Senator Conoco-Phillips’ tax savings of $200 a month, but still we are more than $500 short, and more pertinently we can see clearly where Mr. Sullivan came up with his number, i.e. a single individual earning $73,000 to $74,000 a year who routinely files a short form will realize a tax savings of about $200 a month. BUT THAT IS ONLY A SNAPSHOT OF A SINGLE SITUATION. A single individual earning $148,400 in 2017 incurred a tax liability of $31,627. For 2018 the tax on the same circumstances will be $25,948, a savings of $5,679 or 17.96%. There is a consistent disparity here that needs to be noted because it is a fundamental part of the design of this new tax law. The tax break is not in any sense linear, i.e. if at $30,000 I get a tax reduction of $50 at $150,000 I should get a tax reduction of $250, or five times the amount; that’s linear. Instead if my earnings as a single individual exceed $30,000 2.25 times over my tax savings is 42.22 times as much, which exceeds a first-level exponential progression by a factor of 4; and if as a single individual my earnings exceed $30,000 five times over my tax savings is 136.37 times as much, and that exceeds a second-level exponential progression by more than a third. Imagine what happens when you add a couple zeroes to the end of that annual income number. Otherwise, it seems if single and you earn beyond a certain amount of money and you file a short form routinely, you are going to save a bunch with this new tax law, a whopping 18%. WERE IT SO SIMPLE. When you get married, things get quite a bit more complicated, but what we have with this new tax law is a bunch of dogmatic idiots who got together behind closed doors and created what is in effect a slightly disguised flat tax system, i.e. one size fits all. These are a bunch of boneheads who have decided, in substantial measure because they are incapable of understanding that level of complexity, that a complex tax code is bad, and a one size fits all simplified or flat tax system is preferable. What this denies is the inherent flexibility and imagination that makes Americans the wild and free-wheeling business people they are. Loopholes and ‘what ifs’ are a necessary part of the equation. But these dullards deny this, and so have created a nightmare that I am going to demonstrate to you with one example only. For 2017 a married couple filing a joint return with four dependents:

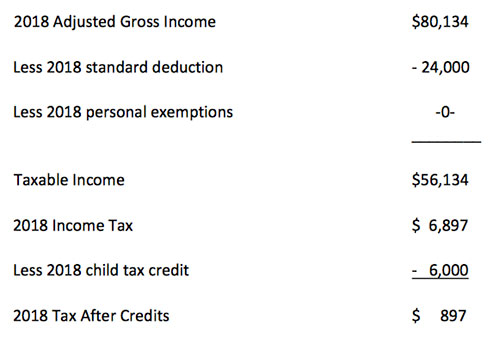

Now watch closely how blunt an instrument using tax credits to try to offset flat tax BS in fact is. The same tax return for 2018 will look like this:

Notice in our example how one of the four dependents already does not qualify for the child tax credit. This could be grandma, or mom, an adult kid on the shorts, or a young person in college or trade school, any number of other possibilities, including your kid’s live-in girlfriend or boyfriend who isn’t working right now. So in our example here the tax savings in the first instance is $220, or 19.7%. So far, so good. But what happens if dependent number two now no longer qualifies for the child tax credit? In this case there are only $4,000 in CTC credits available, and the actual tax due is $2897, a tax increase of $1780 or 159% over 2017. Oops. And obviously it does not get any better if you lose the rest of the tax credits. What if you are about to send twins or triplets off to college (two a year apart comes real close, doesn’t it?)? Then there are no CTC credits, and your tax bill is $6897, a tax increase of $5,780 or 517.5% over what you previously paid. That is not funny, particularly when you consider that this kind of exposure is greatest for those with children, and even greater for those with children in college. But, of course, Senator Conoco-Phillips likes ‘em stupid, so uneducated is a real good start on that. In 1986 the Congress of the United States passed the tax law known as TEFRA, and with emphasis please note what that means, The Tax Equity and Fiscal Responsibility Act of 1986. Tax equity, or fairness, combined with fiscal responsibility; and this “broken system” to use Mr. Sullivan’s words is still good law 32 years later. Months of completely bipartisan effort, more than 30 hearings, and hundreds of expert witnesses combined under the auspices of Treasury Secretary James Baker to create an exceptional and long-lasting major piece of legislation that has stood the test of time very well. This piece of flat tax garbage was created behind closed doors in less than a month by a bunch of dogmatic partisan hacks whose primary purpose was engorging the rich at everyone else’s expense. The Donor Class Tax Bill. Led and rubber-stamped by Ivanka Trump with tax experts specifically not invited. The result is a heaping pile of hot, smelly horse manure on top of which is piled an even larger cumulus of pure, unadulterated BS. Corporations get a 40% income tax cut (at a minimum; you don’t think I can play with this stuff?), and the donor class are planning on going from owning the country to owning the whole damned planet with the universe soon to follow as the spew of their largesse’ orgy. Yes, some Alaskans will get a tax break, and some will get nothing at all. For others tax hikes in the range of 40% are to be expected, and at extremes that are far from the irrational tax hikes for ordinary Alaskans under this new tax law can exceed 500%. So Senator Conoco-Phillips is flat out lying to you when he tells you what a great deal this tax law is. He has not even read it, and he got some assistant to give him a snapshot of a single individual earning $73,000 to $74,000 and wants you to believe that is going to happen to all of you. In fact it is a crap shoot, so have your tax situation checked out closely by someone who knows what they are doing so you can at least prepare. A lot of Alaskans are going to get hammered in the wallet by this new tax law. Nor is this new tax law going to get many of you an increase in pay, a reduction in your utility bills, new jobs created by small business, or a solution to the induced so-called “Alaska Recession.” The tax savings to small businesses is at most 3%, down from 40% to 37% adding income tax and payroll taxes together. That is not enough to make any consequential difference. Only big, big money gets to play this game, i.e. Senator Conoco-Phillips’ PTP buddies. Corporate tax benefits by comparison will be astronomical, as demonstrated literally beyond exponential, and the Federal deficit in the near-term as consequence will explode, is exploding as I write. Corporate profit differentials to a substantial degree will be used to buy back stock which will simply hot-house the stock market, etc. even more than these already are. It will look good for a while before it blows up in everybody’s face. David Stockman, Reagan’s first budget director, was in his earlier manifestation back then a die-hard supply sider, and he to his great credit learned on the job this crap does not work. With the primrose glasses removed he has been accurate in his predictions generally for the last couple decades at least. He refers to current market conditions as “whistling past the graveyard,” and his view is shared by a fair number of other stalwarts. Stockman expects the stock market to crash 60% within 20 months. I expect a crash in late 2019, but I don’t know how far it’s going to go. However that shakes out, everything that Senator Conoco-Phillips is doing is fueling that prospect which in point of fact will only make it worse. Mr. Sullivan’s greatest deceit he reserves for ANWR which he hails as the solution to Alaska’s recession and the realization of a decades-long dream. Oh brother! The Alaska recession has all along been artificially induced by the failure of the state government to collect rational taxes from the bastards that are stealing our oil. This is by design. Pigs are pigs and are incapable of changing their nature. Leave them to their own devices and they will gorge on everything, and then continue gorging. By not paying taxes in the first instance the oil companies and the right wingers get to destroy the state government by starving it of funds. Downsizing is obviously inevitable at that point, isn’t it? Senator Conoco-Phillips lives with the pigs, is owned by the pigs. So what he wants you to believe is that what is good for the pigs is good for you; but he’s lying. Cutting off government funds not only eliminates government jobs, it eliminates government projects done primarily by the private sector, so the economic effects are short-term, and get personal real quick, i.e. with you, too, in the unemployment line. Throughout this period when oil prices declined worldwide, everywhere else oil production declined or was shut down because their costs of drilling were too high. In Alaska oil production increased every year throughout this so-called oil recession, meaning not having to pay taxes on their output they were able to continue to profitably produce for themselves. Thus in the past decade any decline in oil employment due to lack of further oil exploration or whatever was the choice of the oil companies essentially unaffected by market conditions because no tax was imposed on the production. In other words this lack of jobs would have occurred anyway; the oil companies were cutting back while riding high on their legacy fields. But because no tax at all was being imposed by the state on what in fact is state property (the oil) the state government began to run out of money, and that is not going to change because of the opening up of ANWR to new oil exploration. Sure, a few jobs will be provided, mostly to outfits and individuals from Texas, Oklahoma, and Louisiana, with a scattering of foreigners from other nations thrown in. The real profits will be made by the small group of pigs who have coalesced and purchased the Alaska state senate lock, stock, and barrel. Most of your state senators own or work for oil-related businesses, or are members of multiple boards of directors of oil-related businesses. This is almost universally true for those state senators from the Anchorage/Fairbanks corridor. And it is this bunch who have given us these 35% credits to the oil companies for their exploration costs that the state actually gives to the oil companies for the exploration that is going to make them filthy rich, and on which they don’t have to pay any substantive state taxes; but for which the state reimburses the oil companies 35% of their exploration costs. We just opened a whole new section of ANWR up to oil exploration, so the only real question is how quickly will this bullshit get completely out of control and the whole Permanent Fund get drained by the oil companies? Two to five years? Senator Dan Patrick Sullivan can own this new tax law for all I care, wear it proudly like a hair shirt, because it is in fact a piece of garbage through and through. He is a tool for special interests, and rather than being concerned about your well-being or that of individual Alaskans at large, his sole concern is to benefit the PTP pigs he works for. Yes, Mark Begich was a listless personality in D.C. whose accomplishments were at best incidental, but this guy is a completely bought and paid for tool who is specifically working against the common interest, and he lies to you about that. It’s ultimately up to you how much you want to put up with Bob’s belching, farting, and snoring, and his horrid programming choices; all while your tax bill is likely going up; rather than the simple freedom of choices you might have with a Tax Code that recognizes and deals with the subtle differences in the behavior of free Americans. Or go with the simplicity of the stupid inability to understand even the most basic of complex alternatives, and see how far that gets you. **Special Note: The child tax credit did not actually double as originally presented, but instead is $1600 per qualifying child with a $300 to $350 secondary credit applicable in certain situations. How exactly this secondary credit works is unclear at this juncture, thus using the convention of a doubled or $2000 CTC per child simplifies the presentation for ease of understanding what is a relatively complex subject. Needless to say, a reduced credit victimizes the taxpayers affected even more than my presentation indicates. David G Hanger About:

Editor's Note:

Received May 02, 2018 - Published May 07, 2018 Related Viewpoint: Viewpoints - Opinion Letters:

Representations of fact and opinions in letters are solely those of the author. E-mail your letters

& opinions to editor@sitnews.us Published letters become the property of SitNews.

|

||||||