State Sponsored Enabling: Welfare for LifeBy Rodney Dial April 27, 2016

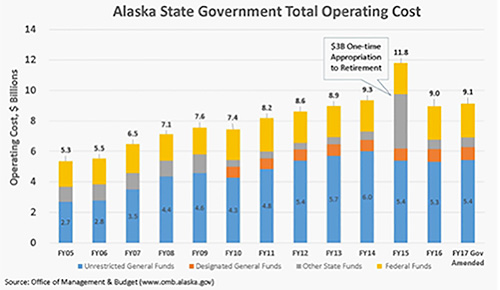

We are days from the end of the legislative session with a high likelihood that the Governor will call a special session to deal with his tax proposals. This marks the second session since the start of the fiscal crisis and the most current projection is for a 4.1-4.2 Billion dollar deficit. Let’s take a moment and consider what has occurred in State Government in the last year and a half. Last session (2015) the legislature and Governor reduced spending (FY16 budget) with most of the reductions to the Capital part of the budget. To explain further, the state budget is composed of essentially three parts; Capital, Operating and Federal funds. The easiest way to understand this would be to compare to your household budget: Operating would be the cost to operate your home, e.g. electrical, heat, etc. Capital would be buying a new car or some other tangible item, and Federal would be like the money a relative gives you at Christmas. Between FY15 to FY16 (we are now in FY16 until July 1st when we will be in FY17) the total budget was reduced from 11.8 billion to 9 billion for a year-to-year reduction of 2.8 billion. At first glance this looks like a significant reduction in one year and it is the number that many use as justification to get a part of your PFD and Income (income tax). The reality however, is far different. The FY15 budget included a one-time, 3 billion deposit to the State’s employee retirement systems (PERS/TRS) that was the result of Former Governor Parnell’s efforts. This action proved to be a good investment and saved the state $700 million this year alone. Anyway, my point is that people who would use the difference between the FY15 budget and the FY16 budget as some measure of “spending reductions” are not giving you the complete picture. As I previously commented, most spending reductions made since the start of this crisis have been to the Capital budget, for things such as buildings, bridges, etc. This is important to remember because many capital projects will simply be deferred to future years and a reduction now only means spending more later. The only true measure of “the cost of government” is in the operating part of the budget. Between FY15-FY16 unrestricted general fund spending only decreased from 5.4 to 5.3 billion. The small operating budget cut is the reason most Alaskans saw no difference in their daily life from last years reductions. Of even greater concern is the fact the reduction only lasts for one budget year. The legislature is currently budgeting for the FY17 fiscal year. Many of you probably heard politicians like our Rep. Ortiz (stated independent, but in the Democratic caucus) claim billions in cuts and their support of the Governor’s budget proposal. If Captain Obvious were to read this letter, this would be the point at which he would say “Of course Rep. Ortiz and other democrats like the Governor’s budget; because it INCREASES spending”. Most of us have heard the Governor propose a $100 million dollar reduction for the coming year; the problem is he is increasing spending in other areas for a net 1.2% increase IF his budget is approved by the legislature. This 1.2% increase was reported in the Alaska Dispatch News (Anchorage Paper) and is reflected in the following chart from the non-partisan State Office of Management and Budget (we are in FY16 and in July will be in FY17).

So here is what is really happening. The cuts to the operating budget, that is the true indicator of the “cost of government”, have been very small as a percentage of total state spending. What they are calling future cuts to the operating budget are simply reductions in the amount of increase they are currently projecting. This would be like saying you expect your household budget to increase by $5000 dollars next year. If instead, your budget only increases by $3000, your budget still went up. Politications would claim the $2000 difference as a savings and that is what is taking place here. The chart above shows total spending increasing next year, not decreasing. One of the things most troubling to me is the length Governor Walker, and even our own Rep. Ortiz will take to maintain wasteful government spending. A little over a year ago, right after the price of oil crashed and the state budget began to take a hit, state employees submitted thousands of recommendations to reduce spending. Virtually none of the suggestions to reduce spending were implemented. You probably also noticed that the Governor demanded that the legislature fund state employee raises last year (Supported by Ortiz at a cost of tens of millions yearly and increasing). Additionally, for months I have attempted to shed light on the massive waste of Governor Walkers Administration allowing “welfare for life” in 138 Alaskan Communities. This is something most Alaskans are not aware of and something many elected officals are desprately trying to conceal. Here is the 411… In 1996, President Bill Clinton signed into law a massive welfare reform bill. One of the elements was the imposition of a 5-year lifetime limit on welfare benefits, called Temporary Assistance for Needy Families (TANF). This bill has been credited with substantial nationwide reductions in States welfare/TANF caseloads. However, in Alaska, Govenor Walkers Administration has specifically exempted 138 Alaskan Communities from the five year limit to allow residents there to collect welfare FOR LIFE. Now at this point in my letter I need to make this very clear… we are only talking about people who have been on welfare for more than five years, and ONLY ABLE BODIED PEOPLE. There have always been exceptions for disabled people to collect welfare for more than five years. What I am talking about is how this administration, is specifically allowing NON DISABLED, Alaskans to collect welfare for life. What is certain is that the Alaska Welfare for life program is fraught with fraud and illegal activities, wasting significant amounts of state funds. In January it was reported by the Juneau Empire that four tribes were calling for an investigation in the use of Welfare/TANF funds after hundreds of thousands of dollars were found to have been illegally used. From the article:

Unfortunately, there are other problems as well. After I started looking into this I was contacted by several employees from the State Department of Health and Social Services (DHSS, State Department involved in this program) who told me the following off-the-record. In addition to the widespread fraud assoicated with this program, they reported that the state was also violating Federal Law by giving cash assistance (welfare) to convicted felony drug offenders (When I asked the DHSS Commissioners office about this they refused to comment and told me the Attorney Generals office advised them they did not have to answer). I obtained a copy of the last significant review of Alaska’s welfare program by DHSS, a report they titled “Evaluating the Challenges to Self-sufficiency Faced by TANF Clients in Alaska”. One of the most significant statememts in this report is that case workers in charge of this program reported the following to their supervisors:

In addition to the monetary cost, there is also a social cost from Governor Walker’s welfare for life program. By providing lifetime cash assistance, the state is fostering an environment that contributes greatly to the epidemics of domestic violence, sexual assault, substance abuse and suicide in rural Alaska. The correlation between unemployment/under-employment and societal problems is undeniable and I witnessed this first hand as a Commander in charge of law enforcement in rural Alaska. I asked various officials in State government to review available data to show the damaging effects of long term public assistance. Specifically, 1. Number of rural communities with violent crime and suicide rates significantly exceeding the national average. Providing welfare for life, for able bodied individuals, does nothing positive for the person or the state. It is essentially state sponsored enabling of poor life decisions. I would simply ask those reading this letter to consider how they would have turned out in life if the majority of what they did every day was… nothing. If you were to collect welfare for life would you be more or less likely to have substance abuse issues? More or less likely to be depressed? More or less likely to engage in criminal behavior? I haven’t even touched on the scores of Alaskans who claim lifetime welfare for a disability. According to DHSS documents, 70% of welfare/TANF clients who claim a disability exemption to the five year limit, claim depression as their disability. The severe structural deficiencies in Alaska’s welfare system have now taken us to the point that we lead the nation in welfare recipients. As reported by the Juneau Empire Newspaper/Associated press:

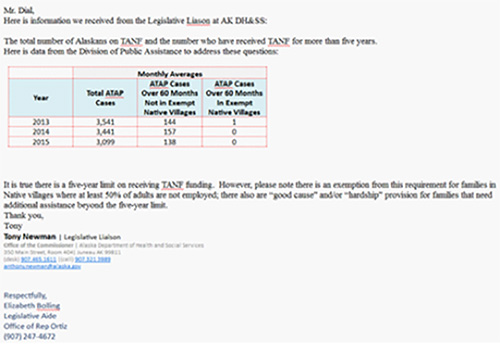

When I first started looking into this and asked Rep. Ortiz for assistance, I eventually received a letter from his office stating that only 1 non-disabled person in the last three years, in an exempt community collected welfare beyond 5 years. See the letter below, received from Rep. Ortiz’s office on 4/7/16. Click here or on the graphic for a larger image.

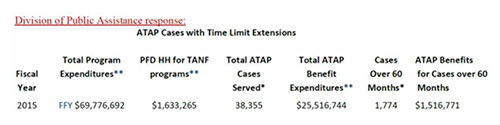

Other parts of the State’s response are telling as well. One of the things I asked for was the amount of money the Alaska Public has deducted from their PFD each year, already, to support welfare. Every Alaskan that collects a PFD pays a yearly tax (look on your PFD pay stub) called a “Hold Harmless”. Last year Alaskans paid 1.6 million in this tax. What is interesting is that this is roughly the same amount it costs the state each year to give abled bodied people welfare for MORE THAN five years. Another interesting aspect of this is the difference between total program expenditures and benefit expenditures ($69 million vs $25.5). The difference, $44.26 million, is the cost to ADMINISTER the program. What is happening is that the state has delegated administration of this program in rural Alaska to the non-profits and PAYS them to oversee it. The State provides this service in urban Alaska, and used to provide it to rural Alaska as well. The change was designed as a way to funnel money to rural Alaska and increased the state cost of this program by millions annually. The state also does this with many other services such as the VPSO program which has around a 25% indirect/administration rate. Here is another way to look at this… The Governor is pushing the legislature to use the PFD and Rep. Ortiz wants an income tax to fund state programs like this. The current PFD plan is to reduce the dividend of all Alaskans by about $1000 this year alone. If they are successful, it will take 25,516 Alaskans each giving up $1000 of their PFD, each year, just to cover the cost of welfare (does not include administration costs). Things like this are the reason our state spends more than double the national average for government. There has not been any significant transformation in the cost of State Government since the start of this fiscal crisis. Many of the stated reductions (capital budget) are simply deferrals to future years. Others cuts have been transfers to the local communities, such as the legislature stopping school bond/debt reimbursement for urban areas last session. This was in essence, the first wave of the Governors attempt to balance the budget on the backs of urban residents (Ketchikan is considered urban). Rural communities continue to get all school construction and funding provided for free from the state, while urban communities must pay 100% of all school construction costs AND pay a percentage of school operating costs. As was mentioned in a House Finance meeting a few weeks ago, only 330 thousand, of the 740 thousand Alaska population works. Of that 330 thousand, only about ½ would pay an income tax if instituted, with the lions share coming from the urban areas. The only thing that is certain, is that oil will eventually rebound in price. It’s a finite resource and world consumption will continue to increase. We must demand serious, real cuts AND legislation that would repeal any PFD or Income tax when prices recover. If we fail to demand “triggers” to repeal taxes when oil recovers, state spending will explode and Alaska will forever become a true welfare state. I will close with this. I, and many other Ketchikan residents have repetedly asked our local representative, Dan Ortiz, his position on the Governor's Welfare for life program. Rep. Ortiz continues to refuse to comment, which in my book is the same as saying he supports it. Feel free to contact Rep. Ortiz on Facebook or by email and ask him yourself.

Received April 26, 2016 - Published April 27, 2016

Viewpoints - Opinion Letters:

Representations of fact and opinions in letters are solely those of the author. E-mail your letters

& opinions to editor@sitnews.us Published letters become the property of SitNews.

|

||