Senate Passes Bill to Limit Government Spending; Takes Annual Draw from Permanent FundBy MARY KAUFFMAN

March 16, 2017

“This bill protects and grows the corpus of the Permanent Fund and protects the dividend,” said Sen. Anna MacKinnon (R-Eagle River), co-chair of the Senate Finance Committee. “It uses the earnings as they were intended to be used at the creation of the Permanent Fund, to provide for the people of Alaska when oil revenue no longer could.” In a prepared statement, Governor Bill Walker said, "The Senate showed great leadership [Wednesday] in passing the Permanent Fund Protection Act. I thank members of the Senate for once again taking a significant step toward building a more stable future for Alaska. Their courageous actions show we are making progress toward a complete solution. I look forward to working with legislators in both chambers to reach the finish line on fixing Alaska." PFD Size Comparison with SB 26 and Status Quo

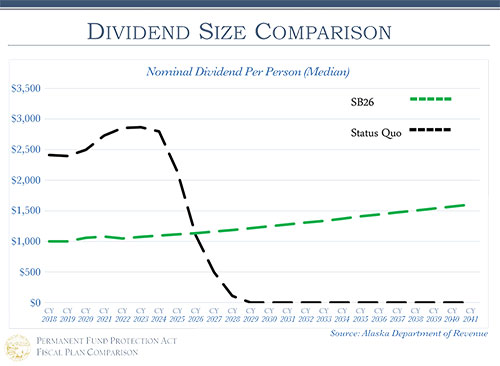

“If we do not take action the dividend will go away,” Sen. Hoffman (D-Bethel), co-chair of the Senate Finance Committee. “Inaction is not an option. We need to take the next step to address the fiscal cliff that the State of Alaska is facing today.” The Alaska Senate Democratic caucus, and several members of the Republican caucus voted No on Senate Bill 26, but it was not enough to stop the bill from advancing to the Alaska House. According to a public FaceBook statement by the Alaska Senate Democratic Caucus, "This bill is NOT a fiscal plan, and does not address any revenue generating measures to fill the fiscal gap. It only cuts in ways that economists have called the most regressive, and the most hurtful to average Alaskans and the economy. It also takes away critical language which mandates that money for the Permanent Fund Dividend is appropriated AT ALL. That means there is nothing keeping the legislature from voting the dividend away." If oil revenue increases in the future, Senate Bill 26 provides a mechanism to return excess funds to the Permanent Fund, growing the corpus of the fund and future dividends, according to an Alaska Senate Majority news release. “Our fiscal solution cuts spending, limits the growth of government and uses the tools we already have,” said Sen. Pete Kelly (R-Fairbanks), President of the Alaska Senate. “A responsible Permanent Fund draw, along with strategic use of our Constitutional Budget Reserve, will resolve our budget problems while protecting Alaska’s private sector. That’s more important than ever as we weather this recession.” Quoting a news release from the Alaska Senate Majority, the SB 26 satisfies the Alaska Department of Revenue’s principles for restructuring the Permanent Fund. The bill implements a rule-based framework, stabilizes the budget, protects both the Permanent Fund and the dividend, and maximizes the use of the earnings reserve. The Senate Majority's target is a $750 million reduction in undesignated general fund spending over the next three years, starting with a goal of $300 million in reductions this year. With prudent use of the Constitutional Budget Reserve as the third-in-line state funding source, after oil revenue and after the Permanent Fund earnings draw, the Senate Majority's solution would be to maintain a $5 billion balance in the Constitutional Budget Reserve (CBR) with the expectation that under this plan, the CBR would start to grow again within five years. SB 26 places a spending cap of $4.1 billion to limit future budget growth which will be adjusted annually to allow reasonable budget growth with inflation. Not included under the spending cap are dividend payments; debt payments; and future capital projects. SB 26 adopts a percent of market value approach to Permanent Fund management to protect the main fund, or corpus, for future generations while paying dividends and drawing a percentage of the fund’s earnings to help pay for government The annual draw will be based on 5.25% of the five-year rolling average of Permanent Fund earnings for the first three years; then, on 5%. Of this draw, 25% will fund dividends for eligible Alaskans, and 75% will help fund the state budget. If oil revenue rises above $1.2 billion, the remaining 75% of the percent of market value (POMV) payout will be subject to a dollar for dollar reduction. The permanent fund dividend will be fixed at a guaranteed $1,000 per Alaskan for the next three years; then, the dividend will be calculated based on the draw, enabling modest dividend growth. Senator Berta Gardner (D-Anchorage) wrote in Berta's Briefing on March 13, 2017, "Now, having spent all the other billions of dollars of resource development earnings - some invested wisely to develop a new state, and some squandered in wild schemes or as political favors - the State turns its eye to spending the Permanent Fund earnings for state services. We still cannot touch the principal itself without the approval of Alaskans to change the State Constitution." Gardner said, "The current value of the Permanent Fund then, created from just 3.125% of all the gross value of resource production, plus increases earned through investments is now at $57 billion, of which $47 billion is principal and $10 billion is the Earnings Reserve Account. Like any other investment, there have been strong years and weak years, but the Permanent Fund managers have a long-term investment strategy and no one can argue that over time they have not done a stupendous job of protecting and increasing our phenomenal asset." SB 26 was transmitted to the Alaska House of Representatives for consideration on March 15, 2017. 8 No Votes:

12 Yes Votes:

On the Web:

Source of News:

Representations of fact and opinions in comments posted are solely those of the individual posters and do not represent the opinions of Sitnews.

|

||