Viewpoints: Letters / Opinions

An Alaska State Income Tax is Not the Answer

By Wiley Brooks

March 05, 2016

Saturday AM

I understand the Governor's income tax bill is currently in the Senate Labor and Commerce Committee (SB 134) Mia Costello is chair. The House bill (HB 250) is in the Finance Committee co-chaired by Mark Neuman & Steve Thompson.

The unpopular “T” word has been placed on the legislative table by the governor. With a projected fiscal crisis ahead, the governor and legislature would be neglectful of their oaths if they did not act to head off a financial meltdown. But, should an income tax be included in the list of responses?

Alaskans deserve better than reinstituting an income tax system tied to such a flawed federal system. The Federal Income Tax System is not only rife with political corruption, extremely complex and burdensome, but it operates inefficiently with archaic technology. It taxes production and discourages hard work, risk taking, saving, investing and entrepreneurship. It would also add to the cost and burden of maintaining records of deductions, credits, exclusions, rebates and other provisions. The hardest hit will be small businesses which create most of the jobs. We need a tax that does not feed the lobbying and accounting industries and minimizes political corruption.

Sixty percent of tax debts are not pursued and 75 percent of those that use off-shore accounts to avoid taxes are not pursued. Millions don’t file a return. The IRS admits a “GAP”, (the amount of tax liability not paid on time) at near one-half trillion dollars. Tax evasion is a $0.6 trillion problem and projected to double in five to six years. The underground economy, estimated to be somewhere between $1-2 trillion, is going untaxed. American corporations are moving their corporate headquarters overseas to avoid a combined state and federal corporate tax rates of about 40 percent, the highest in the Organization for Economic Cooperation and Development. Currently there is over $2.1 trillion foreign profits held in offshore accounts by American companies.

If Alaska adopts an income tax tied to the federal system, near one-half of the tax filers will be exempt from the tax. According to IRS data, 47 percent of individual income tax filers pay zero taxes. If we want a responsible citizenry, then all within our borders should be required to contribute.

Our founders had it right. They authored a document that made a federal income tax by definition unconstitutional. They believed proper taxation must be simple, fair and limited to the functions of government as enumerated in the Constitution. They abhorred a confiscatory tax on earnings.

If Alaska must have a tax, we should not bear the administrative cost and burdens of both an income tax and a sales tax which some have proposed. It should be a consumption based tax only. It is simple, transparent, easy to understand, less burdensome, more economical to administer, provides a much broader and stable taxation base, taxes everyone equally, it is difficult to evade, and; will tax tourist and enterprises that do business in the state. A Fraser Institute study found that sales taxes did a significant less amount of economic damage per dollar collected when compared to corporate and income taxes.

Nationally, the trend is to cut state income taxes and shift reliance to sales taxes. State legislatures and governors all over the nation are seeking ways to compete more effectively to attract business and industry in order to expand their state’s revenue base, and; create good paying jobs. According to ALEC (American Legislative Exchange Council), eight of the nine no-income-tax states rank in the upper half of the 50 states in terms of economic performance. A sales tax would make it less likely than would an income tax to affect the states bond rating.

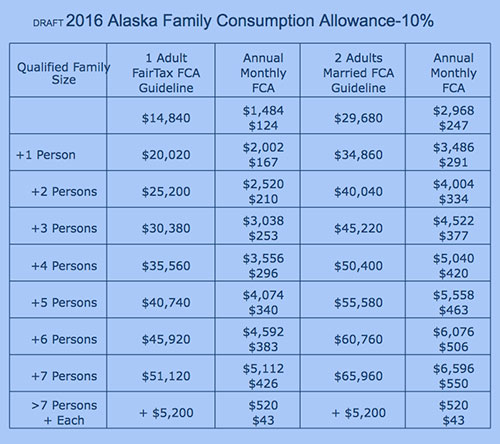

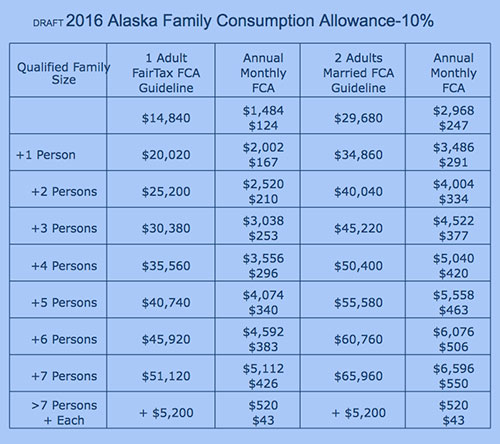

The strongest opposition to a sales taxes is the potential to be regressive. When Americans for Fair Taxation formulated the FairTax they acknowledged this opposition by including what they call a “prebate”. The prebate is essentially a monthly family allowance to ensure that each family unit can consume tax free at or beyond the poverty level, with the overall effect of making the FairTax progressive in application. Based on Department of Health and Human Services standards, no family would be taxed on life’s essential needs. To learn about the mechanics of the “prebate” visit www.fairtax.com.

If PFD payouts are to continue, whatever the amounts, I would suggest they be in monthly increments to provide more economic stability and timely needs rather than an annual boon. Should a consumption tax and a family consumption allowance (FCA) system be implemented, the FCA could be combined with the PFD payments to provide for family needs.

Below is a graphic to illustrate what a monthly FCA would be based on 2016 DHHS published poverty levels. I have used a 10% sales tax rate for illustration purposes. I’m not proposing that rate. That’s an amount for the numbers crunchers and what’s politically possible.

Wiley Brooks

Alaska State Director

alaskansforfairtax@wbcak.com

Americans for Fair Taxation

www.Fairtax.org

Anchorage, Alaska

Received March 04, 2016

- Published March 05, 2016

Viewpoints - Opinion Letters:

Webmail

Your Opinion Letter to the Editor Webmail

Your Opinion Letter to the Editor

Representations of fact and opinions in letters are solely those of the author.

The opinions of the author do not represent the opinions of Sitnews.

E-mail your letters

& opinions to editor@sitnews.us

Your full name, city and state are required for letter publication.

Published letters become the property of SitNews.

SitNews ©2016

Stories In The News

Ketchikan, Alaska

|

Articles &

photographs that appear in SitNews may be protected by copyright

and may not be reprinted without written permission from and

payment of any required fees to the proper sources.

E-mail your news &

photos to editor@sitnews.us

Photographers choosing to submit photographs for publication to SitNews are in doing so granting their permission for publication and for archiving. SitNews does not sell photographs. All requests for purchasing a photograph will be emailed to the photographer.

|

|