Governor's Staff Addresses

Expenses Issues

Governor's Staff Addresses

Expenses Issues

February 24, 2009

Tuesday

Staff for Governor Sarah Palin on Monday responded to persistent

news media coverage of the per diem the governor has collected

while working away from her official duty station of Juneau,

while pointing out significant savings the governor has achieved

in regard to the way she has discharged her official duties.

"The news media have been focused on the $8,500 the governor

has collected in per diem annually while working in Anchorage,

almost 50 miles from her home in Wasilla," said Bill McAllister,

director of communications for the governor. "But aside

from the fact that the governor is legally entitled to these

payments, the media have missed the larger point that the governor

actually has saved the state money by not living year-round in

the official residence in Juneau."

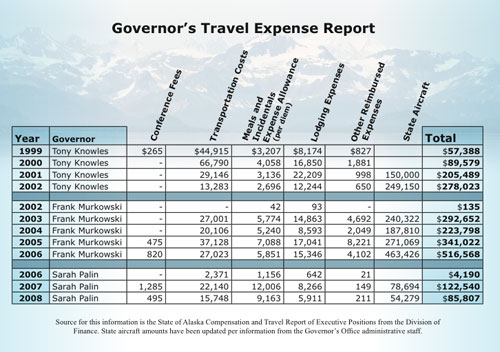

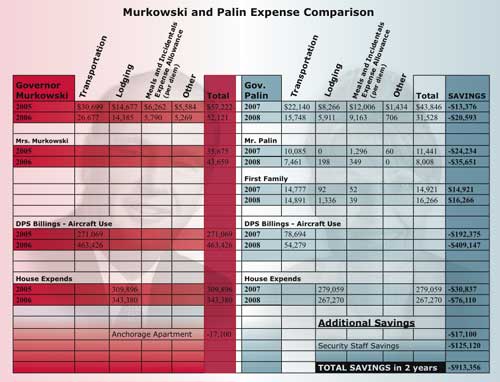

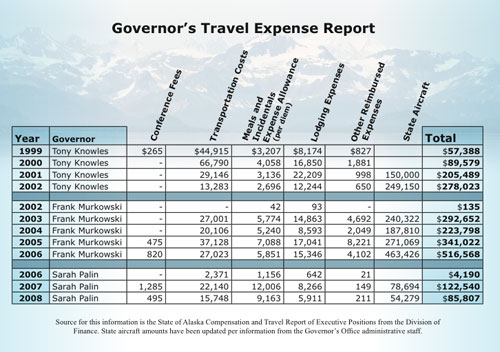

Chart comparing expenditures

among administrations

Chart comparing expenditures

among administrations

Click on the chart to view a larger image.

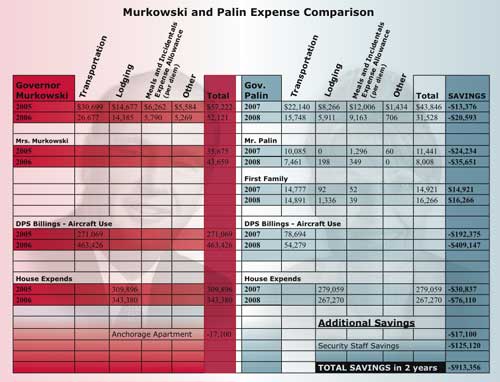

Expense reports for per diem, lodging and travel for the governor

and the first gentleman show a savings of more than $900,000

for calendar years 2007 and 2008, compared with the last two

years of the previous administration. More than $100,000 of that

is attributable to lower costs at the Governor's House.

"Except for the previous governor's much-derided purchase

and use of a jet, this is not intended as criticism of the previous

administration," McAllister said. "But it does show

that the governor's Anchorage-based per diem was offset many

times by reductions in other spending associated with her official

duties."

Meanwhile, questions have been raised about the taxability of

the governor's per diem for days in Anchorage. An internal review

has determined that this per diem is taxable. Kim Garnero, the

state finance director, reported that last week new W-2 forms

were issued to the governor for tax years 2007 and 2008.

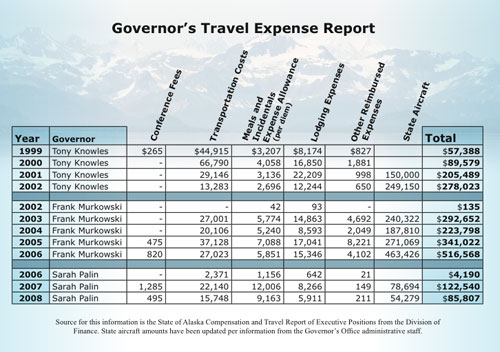

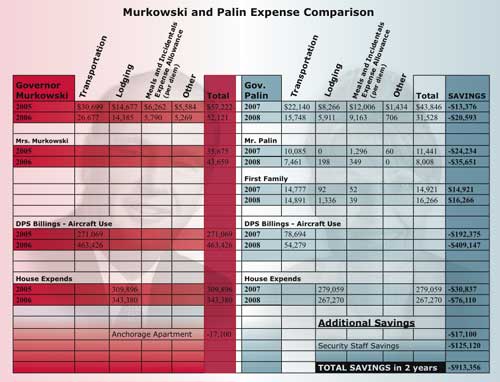

Chart comparing expenditures

among administrations

Chart comparing expenditures

among administrations

Click on the chart to view a larger image.

"The governor has relied upon expert advice in how she handles

these matters, and with this clarification of the per diem issue,

she will make the necessary tax adjustments and comply with all

pertinent IRS rules and regulations," McAllister said. "However,

this tax matter is a personal issue, and is not subject to public

disclosure. Any future per diem payments, of course, will be

a matter of public record," said McAllister.

Questions also have been raised about whether travel by the First

Family to state government-related events amounts to taxable

income. McAllister said an internal review has determined these

expenses are not taxable. McAllister noted that first families

of previous governors have been involved in state government-related

events and that Governor Palin believes it's an important role

for her family as well.

Source of News & Charts:

Office of the Governor

www.gov.state.ak.us

E-mail your news &

photos to editor@sitnews.us

Publish A Letter in SitNews Read Letters/Opinions

Contact the Editor

SitNews

©2009

Stories In The News

Ketchikan, Alaska

|